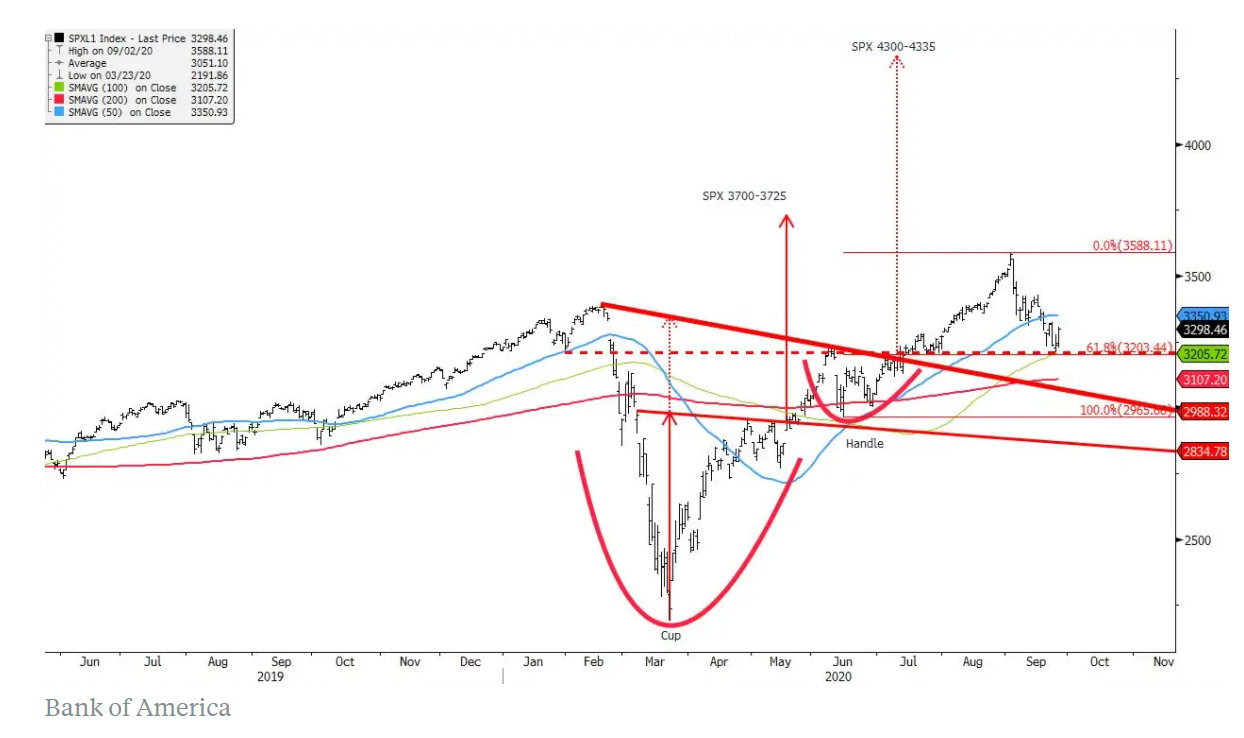

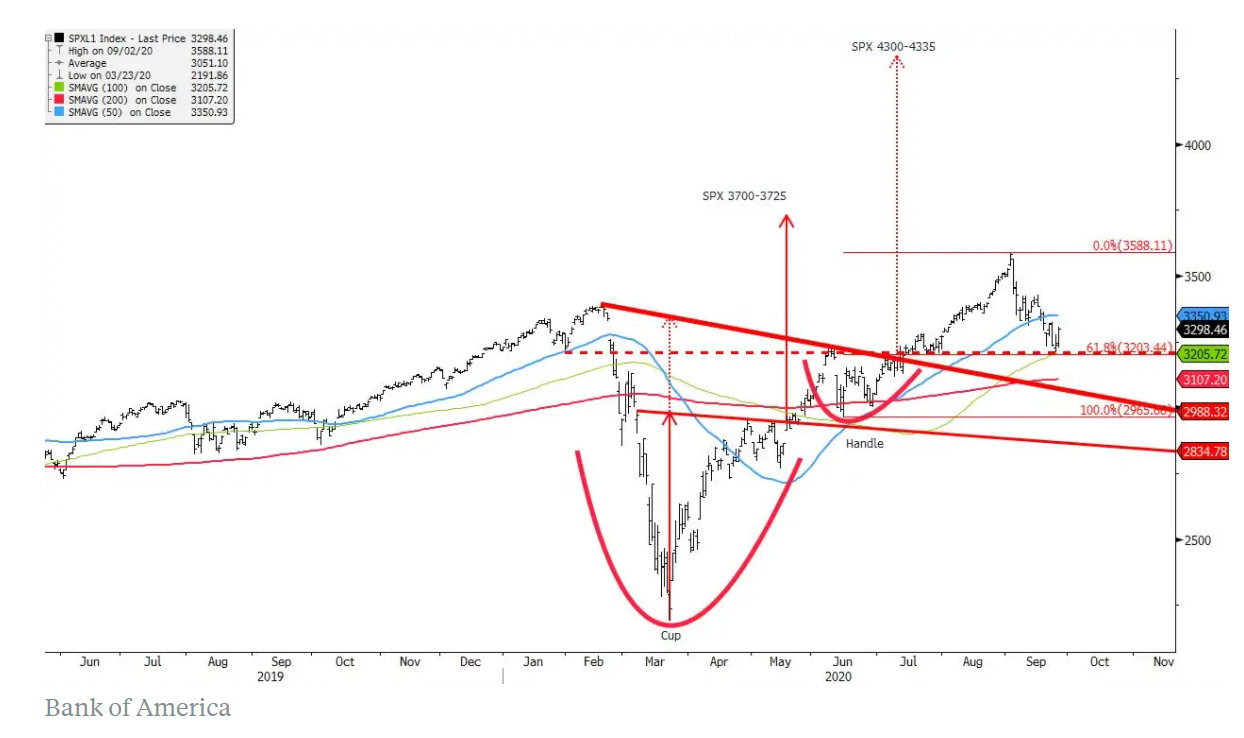

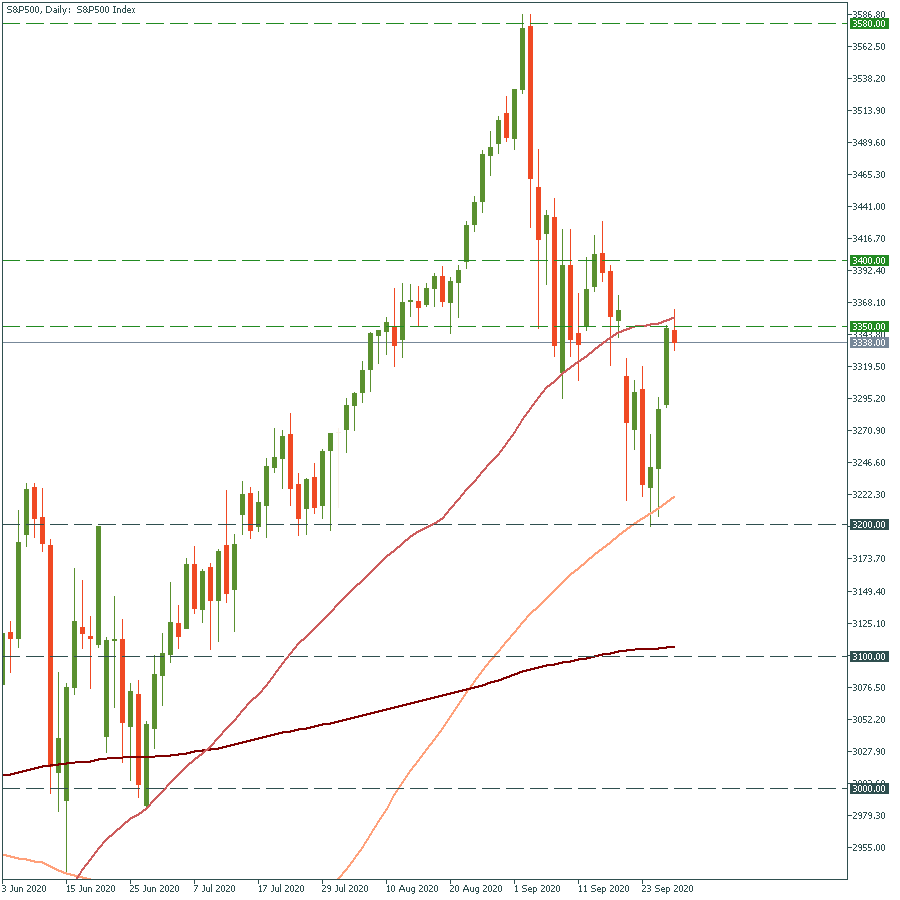

BoA released the report with the bullish forecast for the S&P 500 and shared its technical analysis. It’s quite interesting as the S&P 500 has been dipping throughout September, and it has started recovering just by the end of the month. Analysts from Bank of America assured investors that September’s sell-off is a natural seasonal phenomenon and advised to hold on to the upside in the S&P ahead of November’s presidential elections.

As for the technical analysis, the chart has formed a “cup and handle” pattern, which implies that the S&P 500 is likely to rise up to 3 700 in the short term. Besides, they set the long-term target of 4 300. Bank of America emphasized that while the stock index is trading in a range between 3 000 and 3 200, the doors to the upside are open.

Elsewhere, the bank has noticed that investors have started to borrow more to buy stocks. Following this, the Financial Industry Regulatory Authority recorded the margin debt rose significantly in July and August. All this points to the fact that there is more confidence in further stocks’ rally among investors.

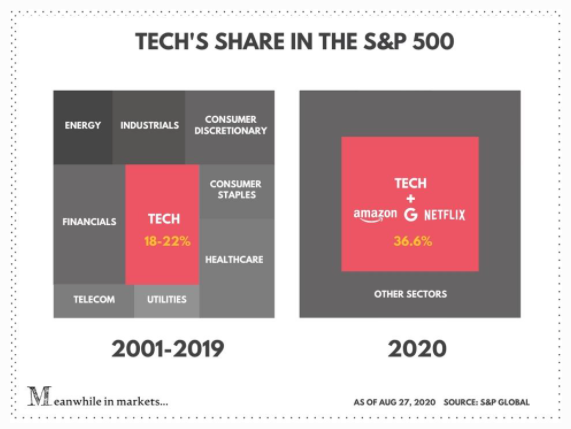

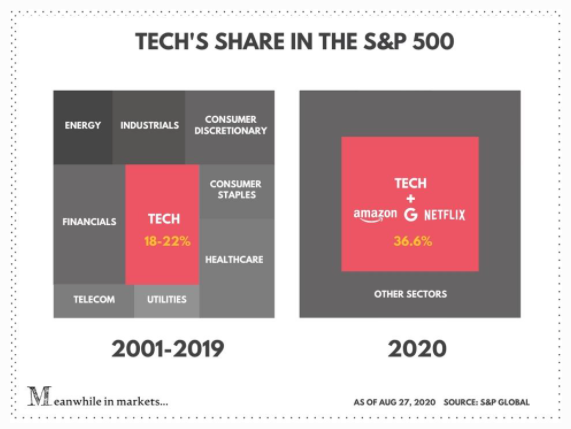

As you may know, the S&P 500 is mainly driven by the top 5 tech stocks such as Facebook, Amazon, Apple, Microsoft, and Google, which is called shortly FAAMG or “Big Five”. Their weight in the overall S&P 500 cap is enormous. According to Forbes, it hit a record of 36.6%. They have just gained during the virus pandemic and keep climbing up further. Tech stocks have helped the stock market to survive, while the energy, financial, and airline sectors have lagged. However, even those industries have started recovering already, showing slow, but steady growth.

Technical tips

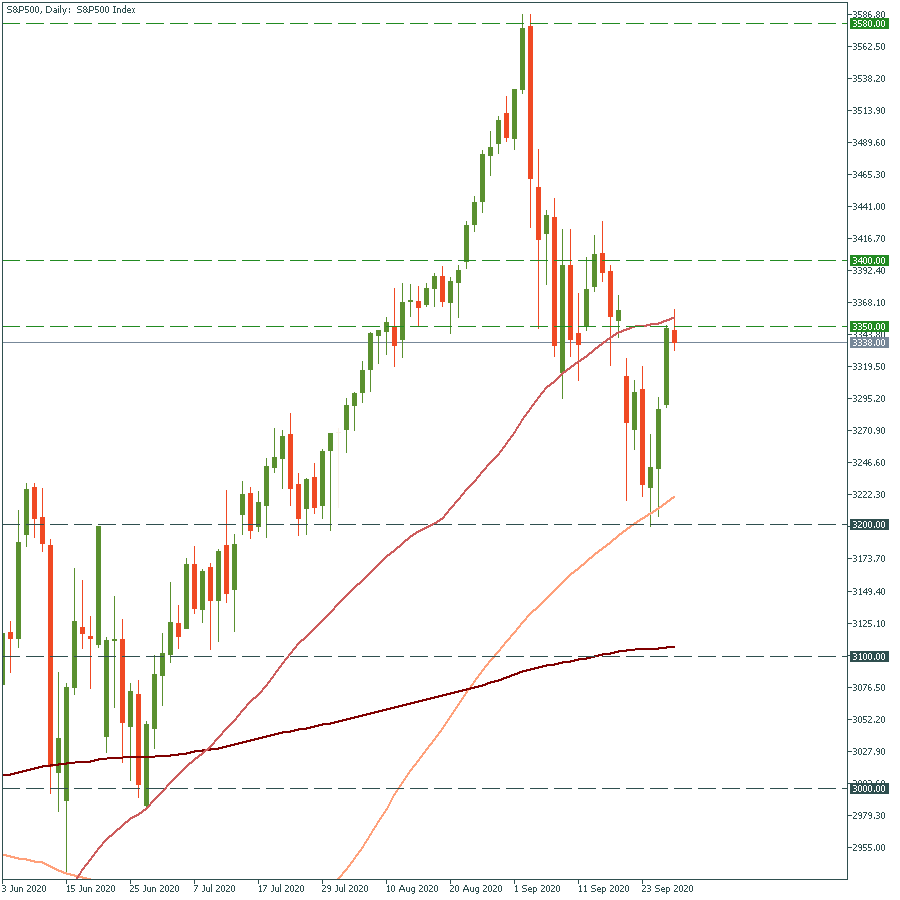

The S&P 500 has bounced off the 100-day moving average at 3 200, showing strong bullish momentum. However, the 50 moving average at 3 350 has blocked the way to the upside. If the stock index manages to break through it, it may reach 3 400. Once the price moves above this level, the way to 3 580 would be open. Support levels are at 3 200 and 3 100.

TRADE NOW