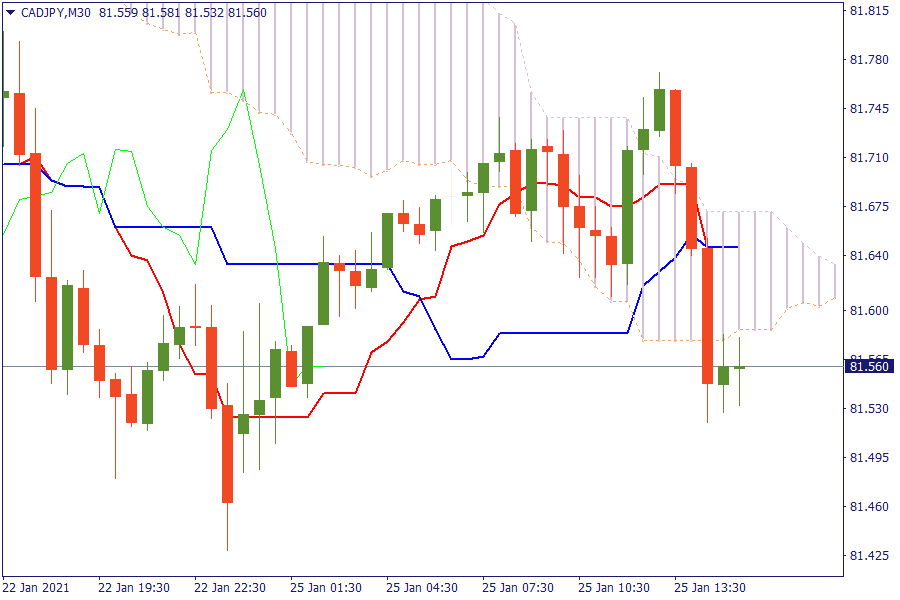

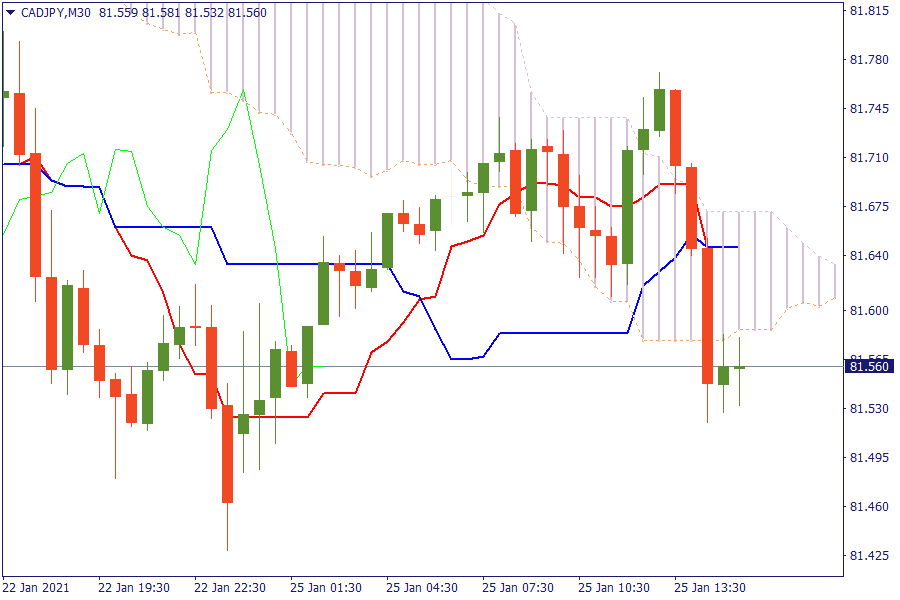

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

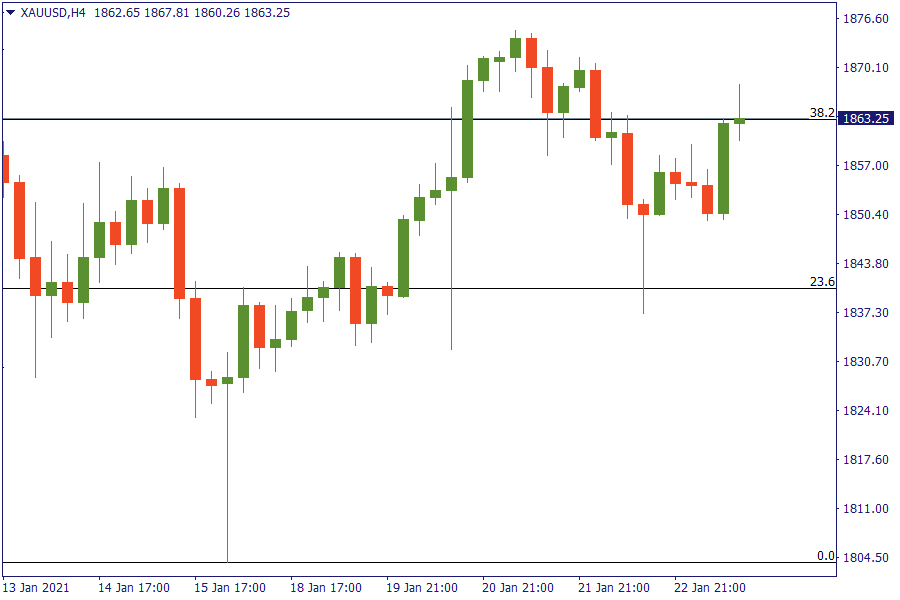

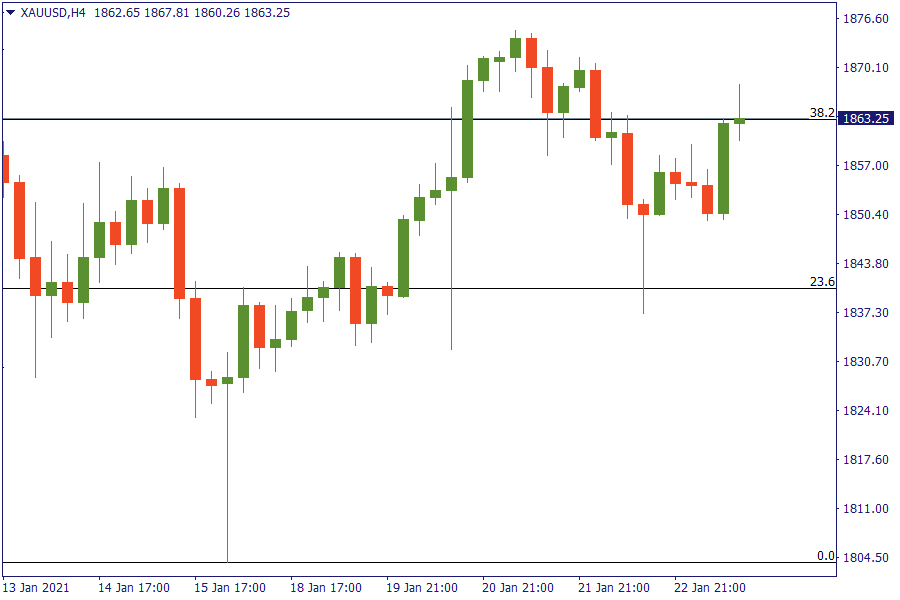

Fibonacci Levels

XAU/USD: Gold after a remarkable selloff is trading above the 38.2% retracement area.

US Market View

US stock markets are set to open the week higher on the back of the improving news flow from the pandemic and confidence in sustained high liquidity, given the loose state of US fiscal and monetary policy. The latter is expected to be reaffirmed on Wednesday after the Federal Reserve’s latest policy meeting. California is set to lift its stay-at-home order, while national infection rates and hospital admissions hit their lowest in weeks.

President Joe Biden is expected to sign a new “Buy American” order, underlining the essential continuity of US trade policy despite the radical change of tone expected from Donald Trump’s administration. Biden’s policy initiatives will continue to compete for attention as the House of Representatives sends the articles of Donald Trump’s second impeachment to the Senate, most likely later Monday. Some have speculated that the fresh impeachment trial will make it harder for Biden to gain bipartisan approval for his $1.9 trillion stimulus package.

USA Key Point

- The NZD is the strongest and the EUR is the weakest.

- EUR/USD pares earlier advance but keeps little changed.

- Germany January business climate index 90.1 vs 91.4 expected.

- BOJ's Kuroda supports that the state of emergency measures may dampen Japan's economic recovery.

TRADE NOW