Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-10-20 • Updated

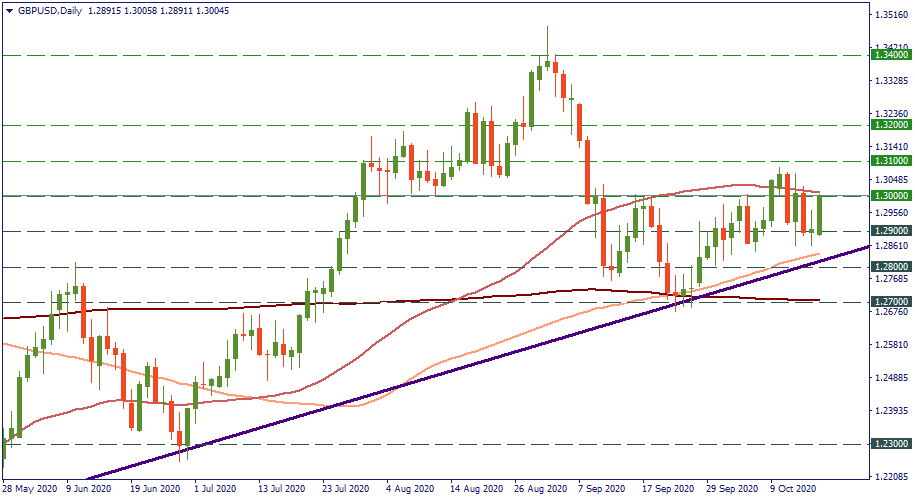

Since July, the movement of GBP/USD has been contained between 1.27 and 1.34. At the beginning of September, the GBP reached a high of 1.34 against the USD while the stock market was seeing its new highest high, and things seemed pretty fine around. Later on, September saw the currency pair drop to the 200-MA at 1.27. In corrected upwards, getting back some of the gain as high as 1.30 but is not stable over there – and there is little surprise in it. Virus, Brexit, and all the related issues are pressing on the British pound.

Technically, higher lows suggest that the trend will be still aiming upwards in the mid-term. Alternatively, going below 1.29, crossing the 100-MA, 1.28, then the 200-MA at 1.27 would be sure signs that the uptrend is exhausted and bears are pressing to aim at 1.23. Is it possible? Yes, depending on the fundamentals.

Fundamentals come to how Brexit goes, of course, but much more than that – how the economic recovery goes in the UK against that of the US. And in the UK, things look pretty bad. The unemployment surged as high as ever, the restrictions are being reinforced, and the economy is slowing down the recovery. Brexit uncertainty is only on the top of that pile making things worse, but not being the “main evil” for the pound. In the meantime, the US recovery seems to be going faster although the recent spike in unemployment alarmed the market as well. In any case, the USD is enjoying relatively high demand while the GBP is hanging in the balance.

Therefore, go for the mid-term strategy: follow how Brexit evolves – that should be clear within a week or so – and watch the technical levels from the downside. If no deal or further dragging of the UK-EU talks loom on the horizon, GBP/USD will likely gravitate downwards. The technical levels lying below will let you know when and whether you should prepare for a below-1.27 bearish strike.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!