Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-10-22 • Updated

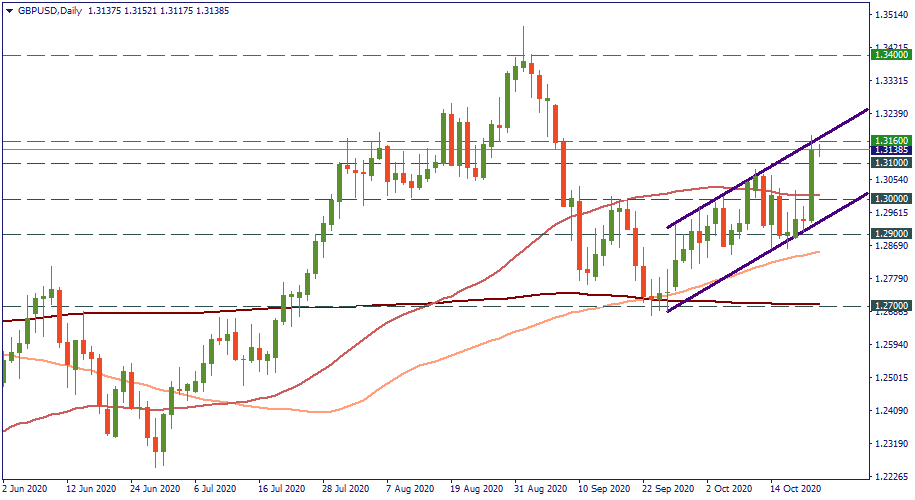

Brexit is stalled, but both the EU and the UK express hopes for a successful resolution. These hopes recently sparked an aggressive spike the GBP went on against the EUR and the USD. What’s the technical outlook?

As surprising as it may sound, those strong moves don’t introduce any change into the existing trends. On a daily chart below, the last large green candlestick is exactly the rise of GBP/USD on Wednesday. The move was really big and doesn’t even have a similar one in magnitude on this panorama. But tactically, it falls well into the uptrend that has been in the place since the middle of September. From below 1.30, GBP/USD rose above 1.31. Most probably, it will go into bearish correction above 1.30 to eventually reverse and rise back above 1.31 on the other side of the uptrend.

Pretty much the same applies to EUR/GBP. After hanging above 0.9040, it plunged down to almost 0.9000. Tactically, that’s just another wave in in a local downtrend that has been in the place since the middle of September. A large one though – you can see that last long red candlestick between 0.9150 and 0.9000. Strategically, that downtrend itself is just another wave in a larger gradual uptrend that’s visible all across the chart. So the observers are right to say that Brexit is merely a local episode for the UK economy – the fundamental factors is what matters.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!