Fed Chair Powell’s comments on the Jackson Hole Symposium resulted in the worst weekly candle in the US500 index since June. Most risky assets experienced severe drawdowns, and EURUSD returned to the above-parity area. We explain everything you need to know about the Symposium in this article.

The most important statements

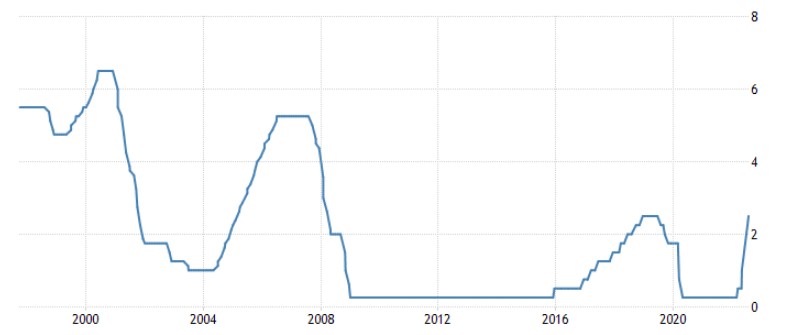

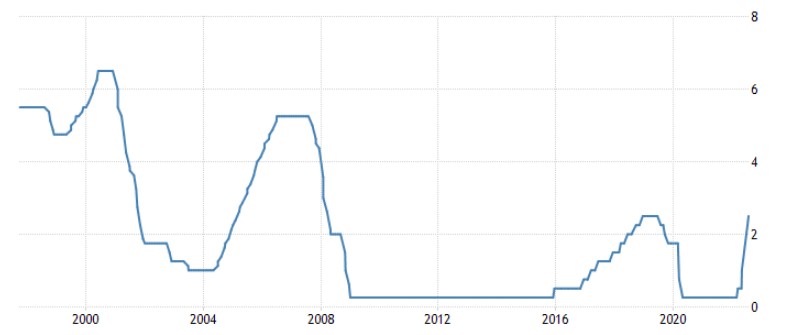

As far as I remember, it was the first time Powell had an extremely hawkish speech since the Covid-19 pandemic. In eight minutes, he pointed directly at current economic concerns, saying that the road ahead will bring some pain to households and businesses. He says it’s an “unfortunate cost of bringing down inflation.” Federal Reserve is ready to imply higher interest rates, even if it does some damage. The next rate change will likely be a 75-basis-points hike, with the following rate changes depending only on the economic data. Also, high interest rates will stay with us for longer before descending.

US interest rates

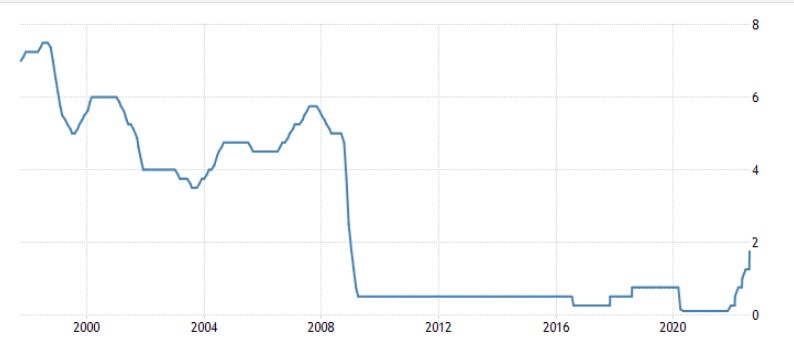

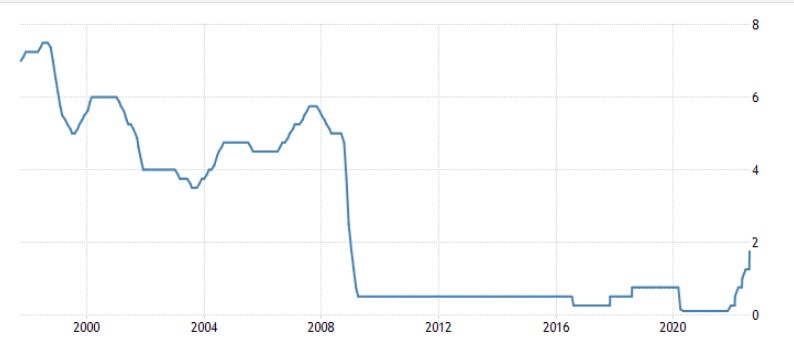

Isabel Schnabel, a top European Central Bank official, said she and her colleagues had little choice but to continue tightening even if Europe’s economy tips into recession, which is becoming increasingly likely. As you can see, the rhetoric is similar to Powell’s, and the effect on the markets is the same. Julia Coronado, president of MacroPolicy Perspectives LLS, said that “even the ECB, which has a much higher chance of a recession in the next 12 months than the US, knows that the direction of travel is you need to raise rates, and you need to raise rates in a pretty steady fashion.”

EU interest rates

The BOE’s governor Bailey had a statement as well. The bank started to wind down (shrink) its balance sheets, which they scaled up during the pandemic to relieve pressure on banks and keep long-term interest rates low. If the bank continues to print more money (wind up balance sheets), it will speed up inflation. The BOE understood that interest rates should be significantly increased, and it’s time to stop creating money. Therefore, it has concerns about banks’ long-term financial stability.

UK interest rates

It became clear that the ECB, the Fed, and the BOE were well overdue with rate hikes, and now they have no choice but to bite the bullet and cool down the economy with the harshest measures. Central bankers’ actions already sent some assets into a freefall and boosted the greenback. Let’s look at various charts to make predictions based on new information.

Sell gold, buy USD?

Right after Powell’s speech (which was the most anticipated at Jackson Hole), the US500 index reacted with a sharp decline and lost 3.47% during the day. The plunge ended right at the 100-daily MA, but the next day opened below it and touched the 50-daily MA. Considering all I said above, the US500 has a high chance of breaking the moving average and declining.

US500 daily chart

Resistance: 4330, 4500

Support: 3900, 3650, 3550

The pair has been moving inside a descending channel for eight months, and while it’s under the trendline, the outlook is bearish—however, multiple divergences on the RSI hint about a soon reversal in the pair. The USD is feeling strong and may push the pair lower to the support level of 0.9700. From it, I expect a gain of bullish momentum and a soar to the parity level and higher.

EURUSD daily chart

Resistance: 1.0390, 1.0790

Support: 0.9954, 0.9700

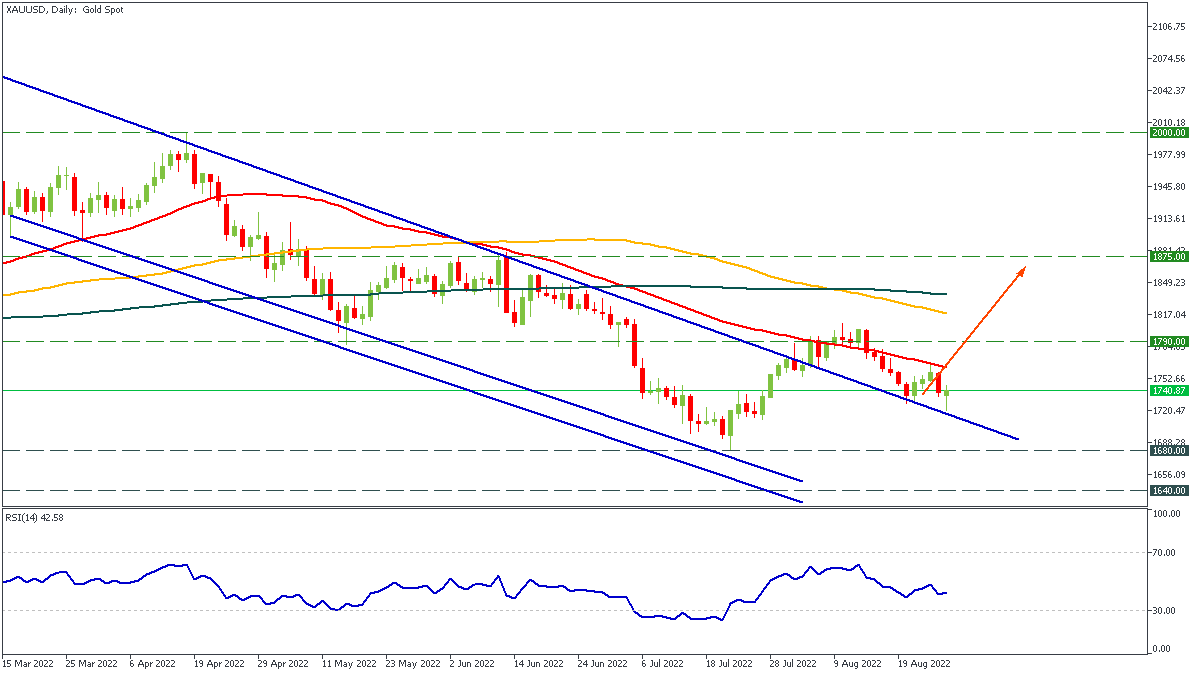

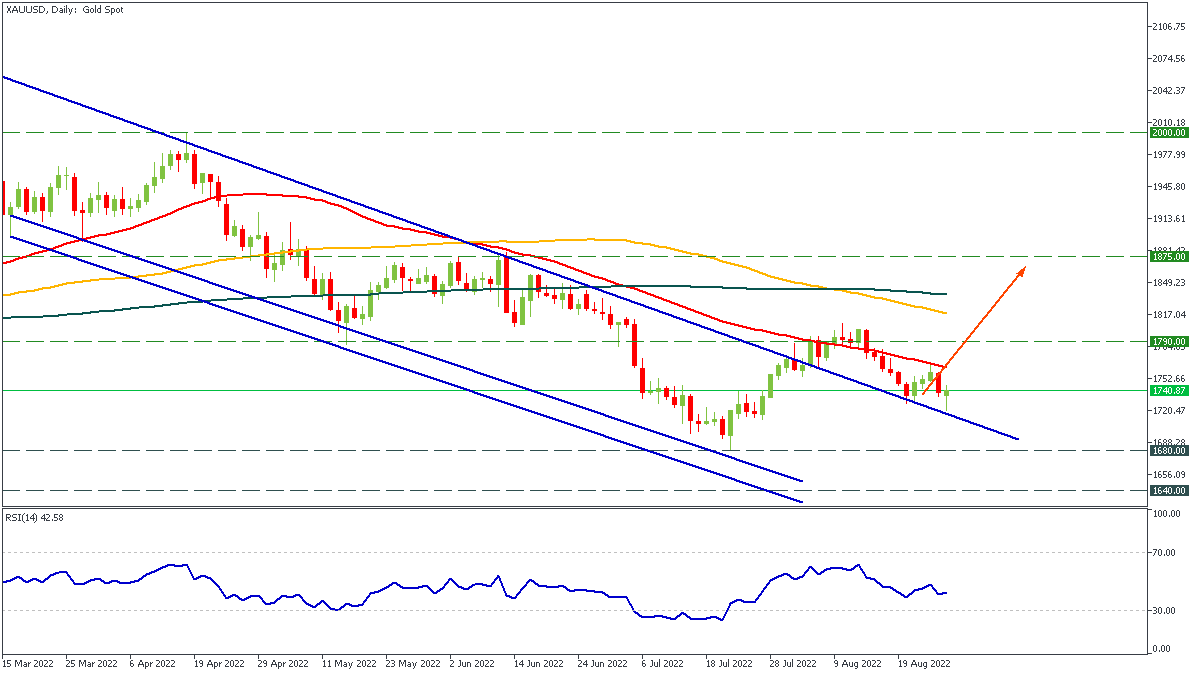

Gold loves the weak dollar, but sometimes the metal can grow with the currency. XAUUSD broke through the trendline and made two retests. I consider this a strong bullish signal for the price, but you must wait for the daily candle to close above the resistance of $1790. For conservative traders, it would be better to open a buy trade when gold crosses the 200-daily MA (dark line).

XAUUSD daily chart

Resistance: 1790, 1875, 2000

Support: 1680, 1640

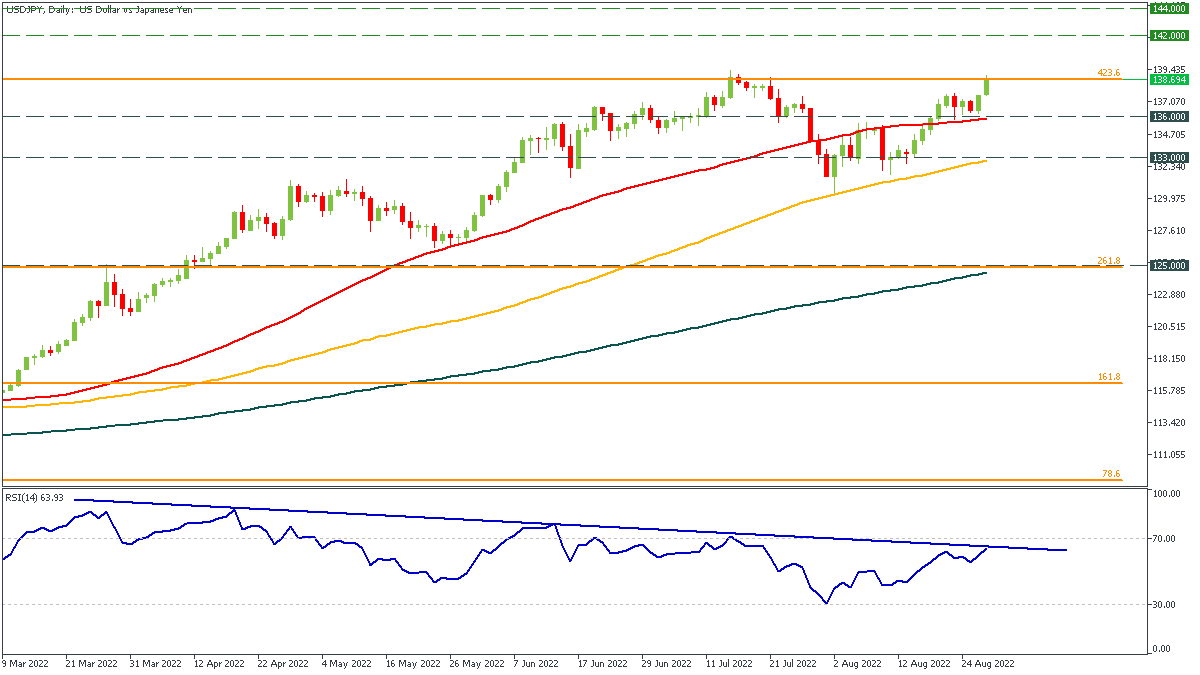

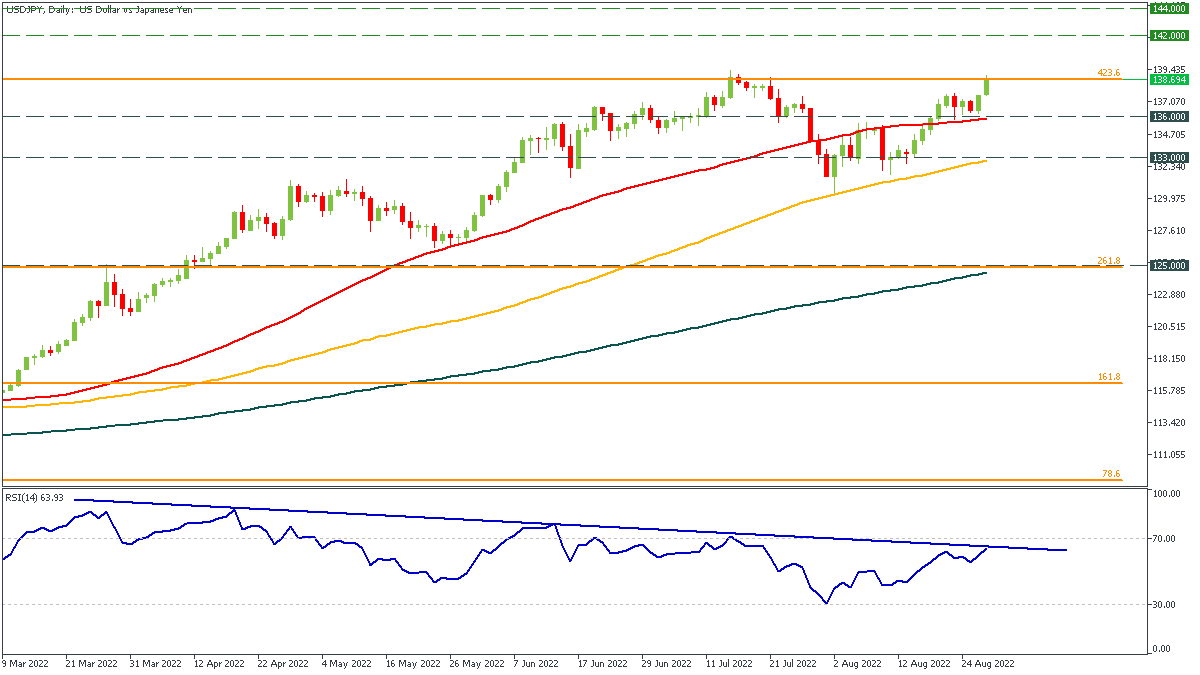

The pair looks bearish due to several divergences on the RSI and retest of the last high. However, the breakout of the previous high will open a road to 142.00 and 144.00 resistances. A bounce from the current levels will signal a trend change despite the USD strength, and USDJPY may slide to the 200-daily MA (125.00).

USDJPY daily chart

Resistance: 142.00, 144.00

Support: 136.00, 133.00, 125.00

The bottom line

There are fundamental reasons for the USD to grow, including hawkish US monetary policy and slowing down of inflation. On the other hand, the technical picture is rather bearish for the USD and bullish for the gold. Even if the greenback grows for another month, it would be the last rally of the US dollar because as the tightening ends, funds will go away from the currency into risky assets.

Do you want to get updates Live? Subscribe to the @FBSAnalytics Telegram Channel, where I post more daily trade ideas!

TRADE NOW