Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-06-25 • Updated

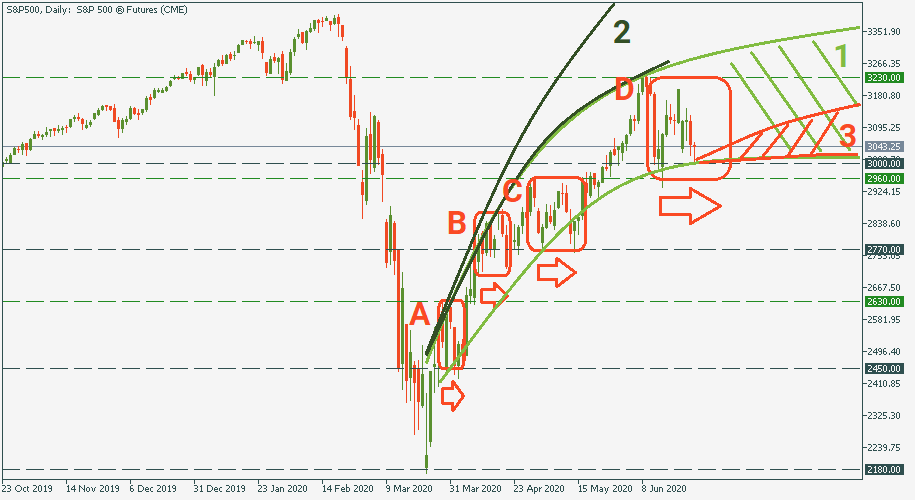

The stock market is going through an interesting phase now. On the one hand, some of its areas – specifically, tech stocks - are booming which alerts observes about investors overconfidence. On the other hand, there is a definite dropdown in the overall performance caused by second-wave virus fears amid new outbreaks. Is the march upwards over then?

Definitely not.

The closer the S&P gets to the pre-virus levels, the more downward gravity it will experience.

Hence, the more horizontally-bent it’s trajectory will look like as it moves upwards to ful recovery.

For this reason, it would probably be unwise to expect the recovery keep the upward pace of March and fall into way too optimistic zone 2 – we are already out of that range.

More likely, zone 1 will be where the stock market will be going – it is the most balanced and moderate expectation.

Finally, zone 3 is also a possibility, at least as a bottom to the channel of zone 1 to which the S&P may drop from time to time.

The horizontal-gravity theory is confirmed indirectly by the fact that each sideways/downward retrace lasts longer: as you move from sector A to sector D (we are currently at the bottom of sector D), you have a longer protraction over time.

Therefore, there is no reason to panic. Yes, there are outbreaks but the fundamentals have not changed yet. Take zone 1 as a realistic expectation of where the S&P goes in the nearest midterm and prepare for zone 3 to provide support at 3,000 for a while ahead.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!