The US central bank, the Federal Reserve, played a major role in saving the global financial system one year ago when the coronavirus crisis hit the whole world. The US dollar has become the top safe-haven currency during the pandemic, which cemented its role as a pillar of the world economy. Will the dollar’s dominance continue? In late March 2020, the Fed dramatically expanded the supply of greenbacks to foreign central banks. As a result, the world may have become too dependent on the US dollar. According to the Bank of England, this is one of the most significant challenges right now. Bloomberg claimed that we are stuck with dollar dominance for the foreseeable future.

Forecasts were wrong – USD rose

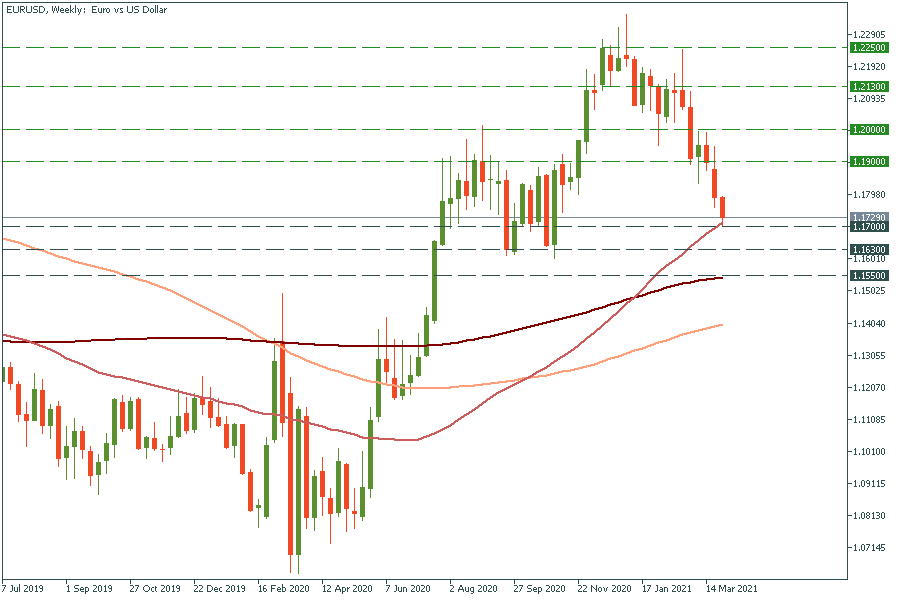

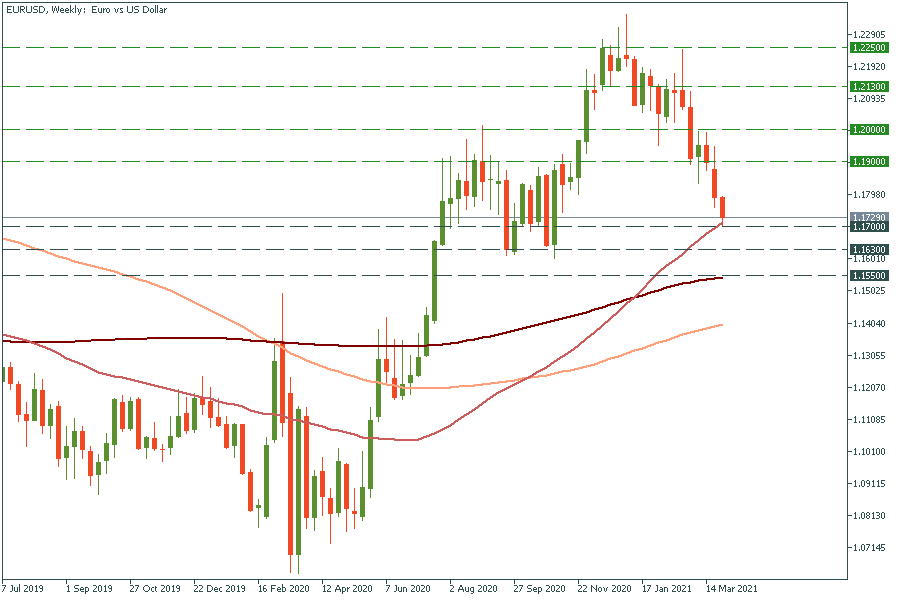

Most analysts predicted the weakening of the US dollar as we were entering 2021. The reasons were logical: the market was flooded with dollars and the Fed pledged to keep rates low for longer. Actually, nothing has changed, but the US dollar is rising! It is heading to the best quarter in 12 months. EUR/USD is at the five-month dips. Gold is pressed down as well. Why? Firstly, Europe has held a poor vaccination rollout, which led to prolonged lockdowns. In contrast to the EU, the US looks much better on the vaccination side. Biden has recently claimed that 90% of adult Americans will be able to get a vaccine by 19 April. Besides, the International Monetary Fund is going to raise its growth projections for the USA, which is again demonstrating the US in a better light than the EU.

Bright future for greenback

Bank of America also pointed out that the steady US recovery may trigger the Fed to tightening the policy sooner than the European Central Bank, which will push the USD further up. Capital Economics anticipates the dollar to strengthen against the JPY and EUR as bond yields in Japan and the Euro Area have the least scope to rise.

Technical analysis

EUR/USD has reached the 50-week moving average of 1.1700. It shouldn’t break it on the first try, but if it does, the way down to October’s lows of the last year at 1.1630 will be open. After that, it may drop to the 200-week moving average of 1.1630. Resistance levels are 1.1900 and 1.2000.

XAU/USD is moving in a descending channel since August of the last year. If it manages to break the 100-week moving average of $1660, the way down to the psychological mark of $1600 will be open. In the opposite scenario, the move above March highs of $1750 will lead the yellow metal up to the 50-week moving average of $1835.

TRADE NOW