Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-01-21 • Updated

Here are the main exotic currencies offered by FBS in MetaTrader: the Turkish lira, Brazilian real, Mexican Peso, Russian Ruble, South African Rand.

Most of them are regional, relatively weak currencies. That’s why, against the USD, they can’t do anything but depreciate – for years. That brings mane advantages to you as a trader - here you go with the reasons why you'd want to look at exotics.

Normally, you have a stable long-term uptrend in exotics pairs.

Therefore, fundamentally, all you have to do is to watch the Central Bank’s actions towards their respective currencies – that’s the only thing that makes the USD less aggressive against its exotic peers.

For example, the monthly chart of USD/TRY below shows a steady uptrend the pair has been in for the entire period of observation. The few downturn periods were mostly a result of the Turkish Central Bank’s action.

Exotic pairs have very similar price performances.

Therefore, it’s easy to predict the move of one by observing the other one.

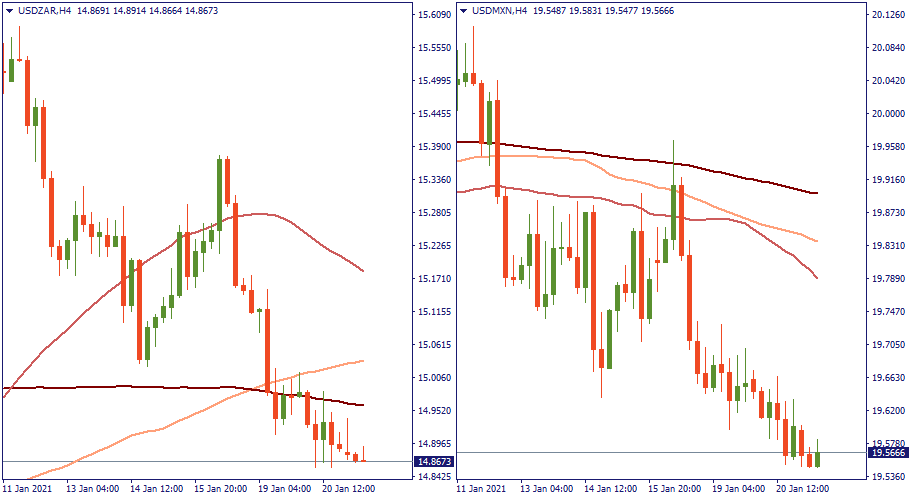

Have a look: USD/MXN and USD/ZAR have almost identical charts below.

Do you think it only applies to high timeframes? Observe the H4. The larger setting is different as the Moving Averages show but the price action is very similar.

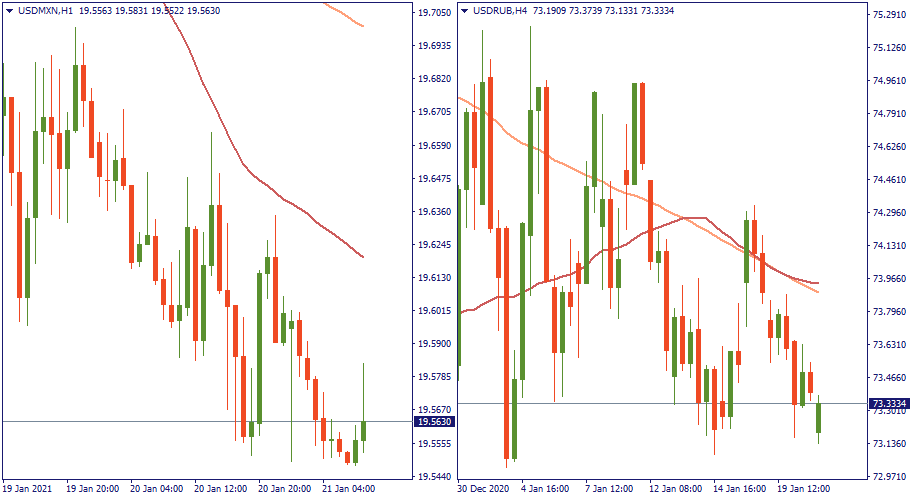

The price performance of exotics is easy to be analyzed with Moving Averages.

On the below H1 chart, USDMXN trades right below the 50-MA so you don’t have to invent your own resistance zones. Similarly, on the H4 chart of USD/RUB, the price trades below the 100-MA and 50-MA regularly tipping above it and diving downwards again.

Due to their weakness, exotics are often volatile – hence, potentially profitable.

Just look at that USD/RUB chart – how many swings it did, and how much benefit you could get, especially if scalping is what you like.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!