Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-01-28 • Updated

Fed has held the first meeting this year. The bank takes a wait and see approach and leaves both rates and QE pace unchanged while the debt is mounting. Analysts believe that no changes from Fed may be understood as an indirect light-tapering scenario. Higher real rates could be unveiled already in the next quarters. These expectations underpinned the USD.

Elsewhere, Fed’s Powell said that the US economy was still far away from full recovery during his press conference. As a result, the market sentiment worsened and drove safe-havens assets such as the USD upward.

As for the CAD side, the reduced demand for crude oil pressed down the commodity-sensitive Canadian dollar. The constantly rising virus cases added to the overall risk-averse mood as well. All eyes on US GDP and jobless claims at 15:30 MT time. Follow up!

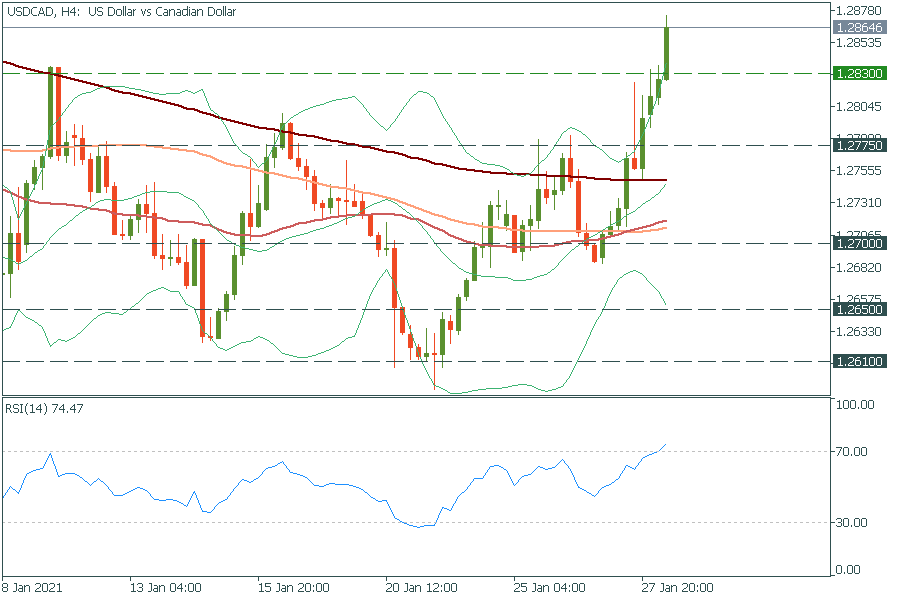

USD/CAD has just broken through the resistance of 1.2830, clearing the way up to the psychological level of 1.2900. However, the rally up should stop near this level as indicators signal a soon falling. The RSI indicator moved above the 70.00 mark, entering the overbought zone. In addition, the price has broken through the upper line of Bollinger Bands, indicating the soon pullback to the downside. Support levels are at the low of December 4 at 1.2775 and the psychological mark of 1.2700.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!