Today's FOMC meeting is the highlight of the week, and Antje Praefcke, FX Analyst at Commerzbank, discusses the USD outlook ahead of the announcement. Praefcke believes there's low risk of the Dollar declining post-meeting due to unlikely dovish surprises, especially after strong inflation readings. Instead, the Fed may emphasize caution and confirm market expectations, limiting potential USD losses. The focus shifts to how much further the Dollar can strengthen, depending on how closely the Fed aligns with market expectations and Powell's stance on interest rate cuts during the press conference. Overall, while expectations are present, the extent of Dollar gains remains uncertain.

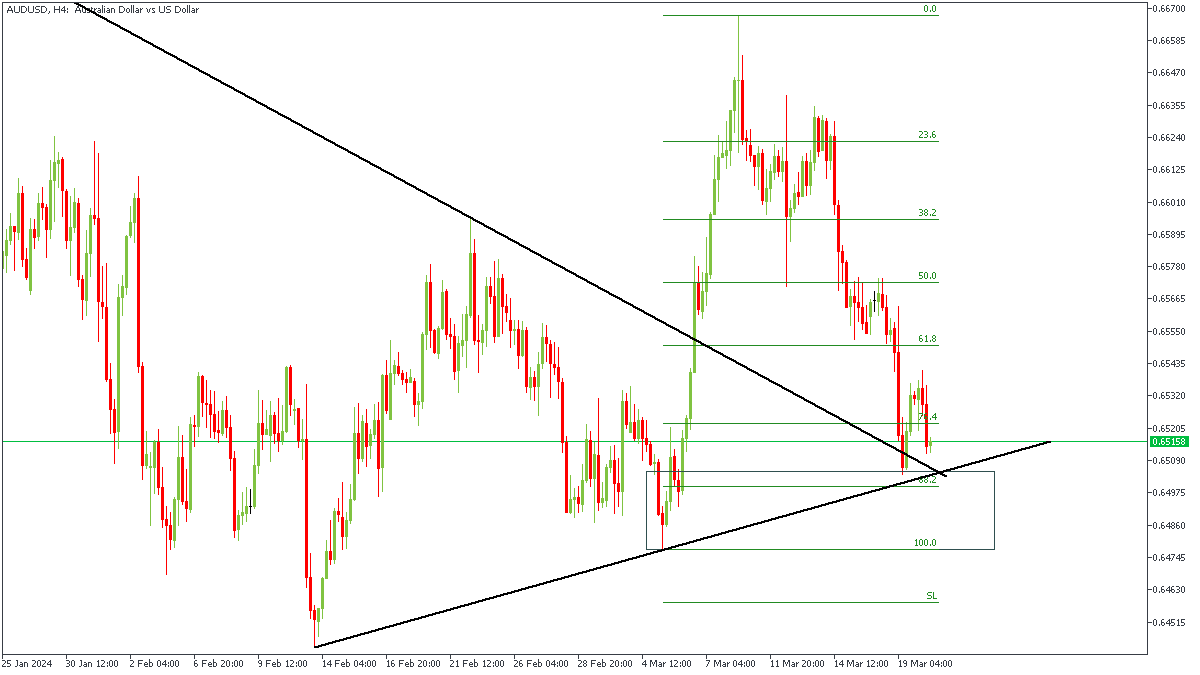

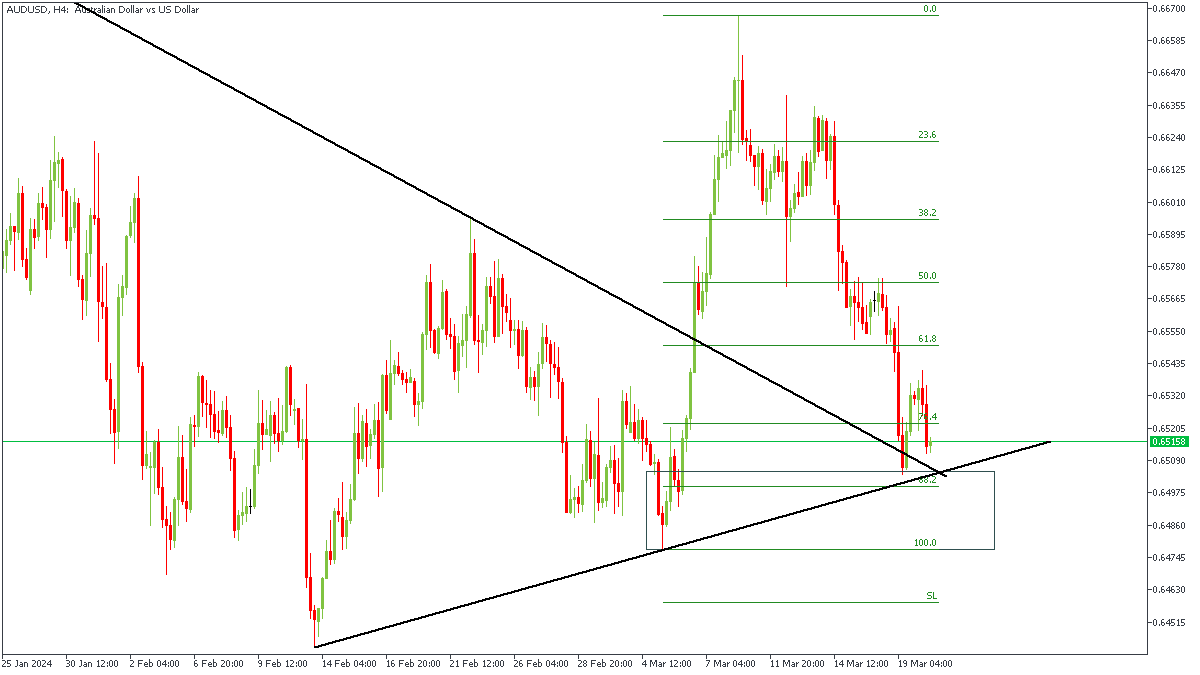

AUDUSD- H4 Timeframe

AUDUSD on the 4-hour chart recently broke above the previous high, as well as the previous trendline resistance. This break of structure thus presents us with a turncoat trendline, as well as a demand zone. Combining the powers of the double trendline support, Fibonacci retracement level, and the drop-base-rally demand zone, I vote in favour of the bulls in this case.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66075

Invalidation: 0.64764

EURUSD - H1 Timeframe

Similar to what was presented on the AUDUSD chart discussed above, I can see the clear break of structure in the case of the EURUSD chart too; as well as the trendline support and the Fibonacci retracement level. As before, my verdict in this case remains as bullish as earlier mentioned.

Analyst’s Expectations:

Direction: Bullish

Target: 1.08962

Invalidation: 1.07964

GBPUSD - H1 Timeframe

In the case of GBPUSD, we are presented with a clumsy price action movement. Here, price is a couple of pips away from the intended area of support, which only leads me to believe that price would do a nosedive into the demand zone, before we see the actual impact of the FOMC data on the markets.

Analyst’s Expectations:

Direction: Bearish

Target: 1.26387

Invalidation: 1.27345

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.