Foreshadowing changes

The US dollar has been enjoying increased demand among other currencies throughout recent months. That is understandable: once a problem hits the world, there is nothing to run for… except for the USD. However, the crisis, as heavy as it is, especially in the US with its persisting infections rate, will slowly go away. With it, the demand for the US dollar will also go away. But when it does, will the USD calmly sit back again on its throne of supremacy in the world of currencies?

A decade of reigning: primary currencies

EUR/USD started declining in the crisis of 2008, then got back up, but the overall trend is clearly looking downwards. It has to be noted, though, that the last three years are showing the appreciation of EUR and its reluctance to dive below the middle of the channel. It is consolidated horizontally, and if things go well for the EUR, it will renew the 2017 highs. If that happens, the decade-long backbone of the trend will be broken.

Against the GBP and JPY, the USD also has been having an upper hand since the beginning of the previous decade. GBD/USD has been going down since 2012 – but note the stable support at 1.2050. USD/JPY moved up from 80 to above 120 during 2012-2015. But in 2016, it lost momentum and has been in strategic consolidation at a lower level of 107 ever since.

Finally, AUD and CAD also present roughly the same picture. On the monthly charts, AUD/USD has been going down for as far as the eye can see, and the CAD has been a hostage of the USD in a similar manner. But both contender currencies are challenging their trends currently, with their respective support and resistance being almost intact. Do we have a conclusion then?

The primary observation is that the recent decade has been a decade of the USD’s supremacy. The secondary observation is that since recently, this supremacy seems to be eroded. The EUR, GBP, JPY, AUD, and CAD – irrespective of their own particularities and history of relationship with the USD – are showing that “something strange” is happening with the undisputed strength of the USD. Simply put, it’s getting softer.

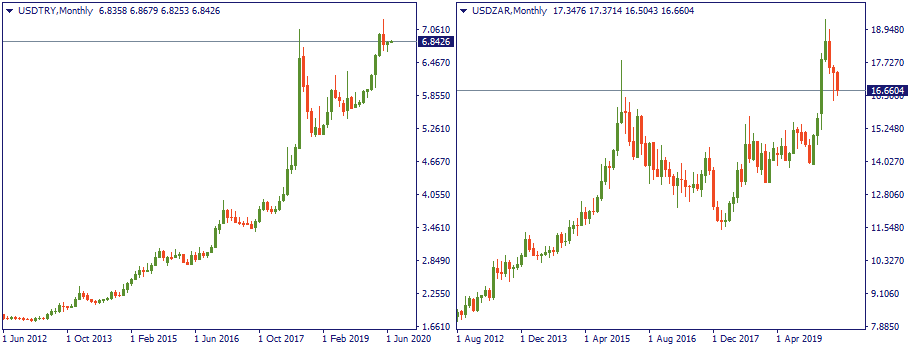

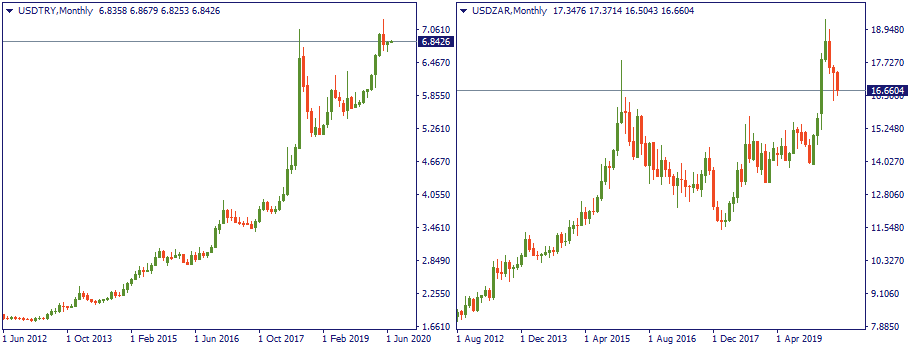

A decade of reigning: developing currencies

Do the above conclusions concern the RUB, MXN, ZAR, or TRY? Well, to a certain extent – yes, but in reality, the USD is unlikely to weaken to such an extent as to give chance to the exotics to rise above it. Maximum what these can count on is a slower pace of depreciation of the USD. Fundamentally, that may be well explained: if there enough problems in the outside world and inside of the US to make the USD softer, the same problems will press on the exotic currencies even harder. At least, because each of them is tightly linked to the USD and the world economy and, hence, are much more sensitive to any global issue that the US dollar.

Outcomes

Here are some processes that are already taking place. The crisis is coming to the end, and the recovery is underway – that pushes risk-on moods and puts away safe-haven preferences. China is constantly advancing in its global economic presence – this fundamentally increases global interest to the Chinese yuan and other currencies, and further decreases attention to the USD. The US authorities under Donald Trump are leading a protectionist foreign economic policy, which also presses on the USD and strategically erodes it’s international stronghold – such as Hong-Kong, for example, even if it’s indirectly linked to the USD through the GBP. Europe is trying to assert it’s economic power – in increasing clashes against the US economic interests.

In fact, the more you investigate, the more you will find reasons to doubt the strength of the USD in the future. “But China, Europe and all other countries with their respective currencies have the same layout and do also have problems” – yes, true, but there are some observable realities to recognize. Maybe, there will be another decade of the USD’s supremacy. Maybe not. But clearly, we are currently in the phase which that later on may be described as a turning point. Will the post-crisis period change the global economic layout and tilt the table away from the USD? Time will show. But what’s true is that definitely, strategic positions of the US economy in the world stage are very different compared to 2010-s, and hardly anyone will say that they are stronger.

LOG IN