Last year was tough for the Japanese yen. USDJPY gained more than 30% over 2022, striking above 150 in October. While anticipation of slower Fed rate hikes pulled the pair below the 130 level at the start of 2023, the speculations over the destiny of BOJ’s yield control policy grabbed the attention of the Japanese assets in the middle of January. What lies ahead for traders of the Japanese yen?

How does BOJ affect the market?

The Bank of Japan is famous for its slow and steady monetary policy, which aims to boost economic activity and fire inflation. There are two main tools that the BOJ uses: the negative interest rate at -0.1% and the yield-curve control, which allows the 10-year government bond to fluctuate within a pre-determined range to reach the 0% yield target.

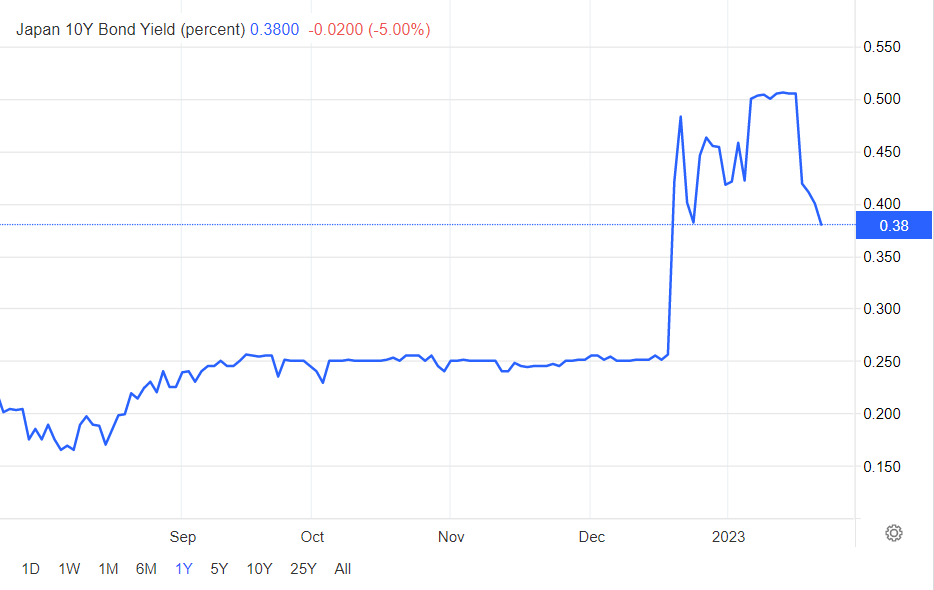

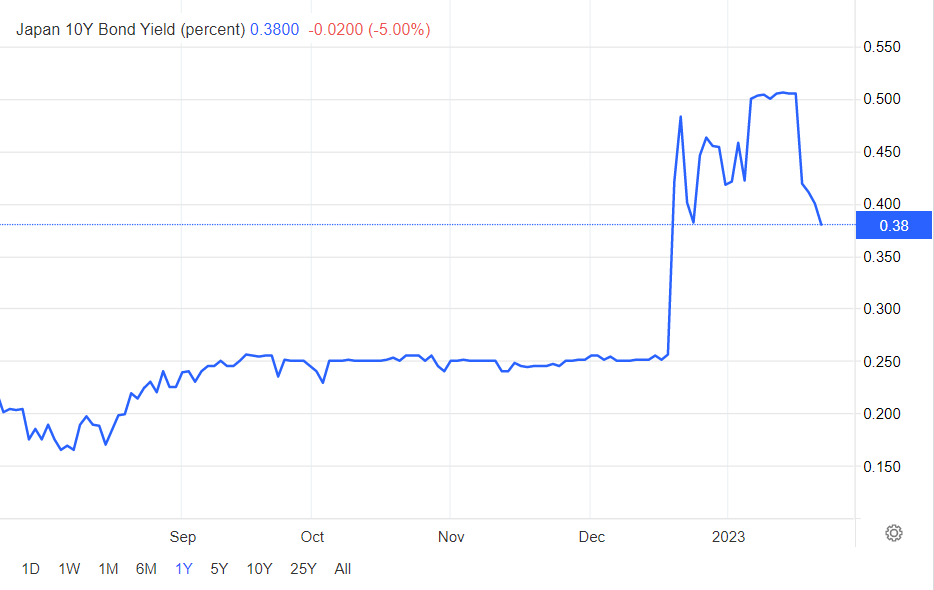

The Bank of Japan’s yield-control policy, introduced in 2016, aimed to keep yield meager to encourage consumer spending. This, in turn, should stimulate inflation. In 2018, the Bank of Japan announced that the 10-year yield could increase by 0.1% above or below zero. In March 2021, the regulator made the band wider to 0.25% in either direction to reactivate the market’s activity. In 2022, the BOJ raised the ceiling to 0.5% above/below zero and increased bond-buying amid the escalated pressure on the Bank to raise the interest rate. It also added speculation that the Bank would abandon the long-term rate target.

However, on January 18, the Bank announced no changes to the monetary policy, which pulled the 10-year bond yield lower to 0.38%.

The market mood changes resulted in the Japanese yen going up and down in January. USDJPY fell almost 14% at the beginning of the month but started rising after the Bank declared the continuation of the easing monetary policy. Despite that, analysts don’t believe in the long-term weakness of the Japanese currency.

Factors that may strengthen the JPY

Many factors may affect the long-term weakness of the Japanese yen.

First, the inflation rate, which hit 4% in December 2022, may push the central Bank into action. According to the Bank of America, the inflation rate may skyrocket far above the market consensus (3% vs. 1.9%).

Another point for the hawkish policy shift is related to the upcoming end of the BOJ Governor Haruhiko Kuroda's term. Analysts warn that the BOJ may repeat the Fed's transitionary rhetoric and start making hawkish steps too late.

If this is true and the JPY gains its strength, we may see USDJPY sliding below the 127 level. In that case, the following targets for sellers will lie at 122.30 and 114.70. The selling pressure may increase after the retest of the 50-day SMA at 133.50.

If you want to take advantage of the Japanese yen, join FBS. With FBS, you can trade USDJPY, EURJPY, and GBPJPY on favorable conditions, including fast execution and leverage up to 3000.

Conclusion

The recent monetary policy decisions weakened the performance of the Japanese yen. However, high inflation and a leadership change in the Bank of Japan may result in USDJPY sliding below 120.