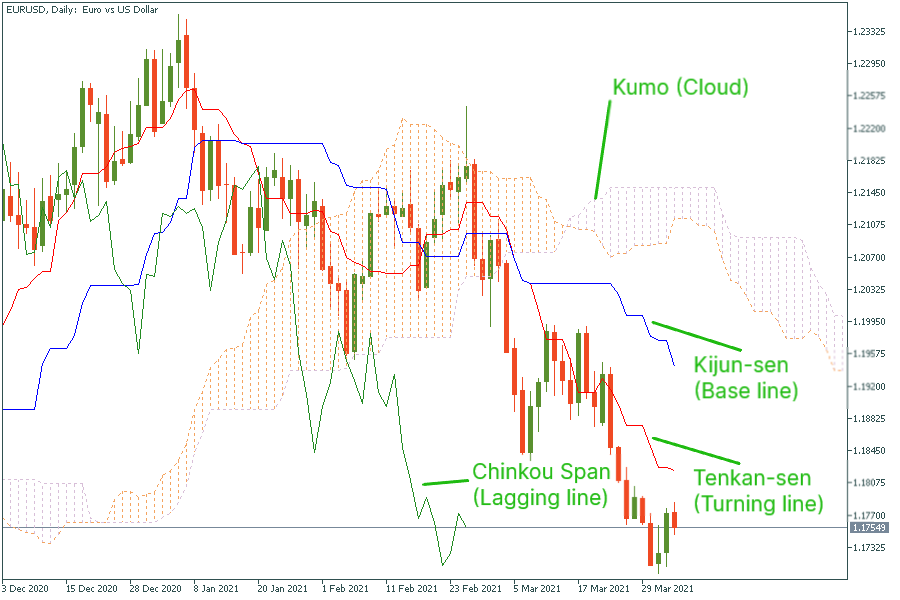

When you give a first glance at the Ichimoku indicator, it may hurt your eye. Just take a look at the picture below.

Let these sharp lines and stripes not scare you! In this article, we will teach you how to use this complicated tool for your successful trading decisions.

What is Ichimoku?

Ichimoku Kinko Hyo (Ichimoku) is a complex and very informative technical indicator. In Japanese, it means a “glance at a chart in equilibrium”. In this article, we will provide a brief explanation of indicator’s purposes and elements needed for our strategy. If you want to go into the depth of trading with Ichimoku, we recommend you to visit the FBS Guidebook.

What parts does Ichimoku consist of?

There are five main parts of the Ichimoku indicator.

- Kumo (Cloud) – the important element of the indicator, which is formed by the 2 moving averages named Senkou Span A and Senkou Span B. The part of the cloud that is on the right of the current price (in the “future”) shows the power balance of the market. The part of the cloud that is aligned with the current prices acts as support and resistance for the price.

- Kijun-sen (Base line) – long-term 26-period MA.

- Tenkan-sen (Turning line) – short-term 9-period MA.

- Chinkou Span (Lagging line) – closing price of the current candle which has been moved 26 periods back.

What Ichimoku is useful for?

Ichimoku is great when you need to identify the direction and the strength of a trend. It also helps to set support and resistance levels. Most importantly for us, Ichimoku can be used for building an effective trading system.

Day trading strategy with Ichimoku and Stochastic Oscillator

For the strategy we are going to explain below, we need the Stochastic Oscillator with customized settings that will be used as a filter.

Basic inputs for implementing the strategy

Timeframe: daily

Currency pairs: majors

Indicators: Ichimoku (default);

Stochastic oscillator with the following settings:

%K period = 5; %D period = 3; Slowing = 3.

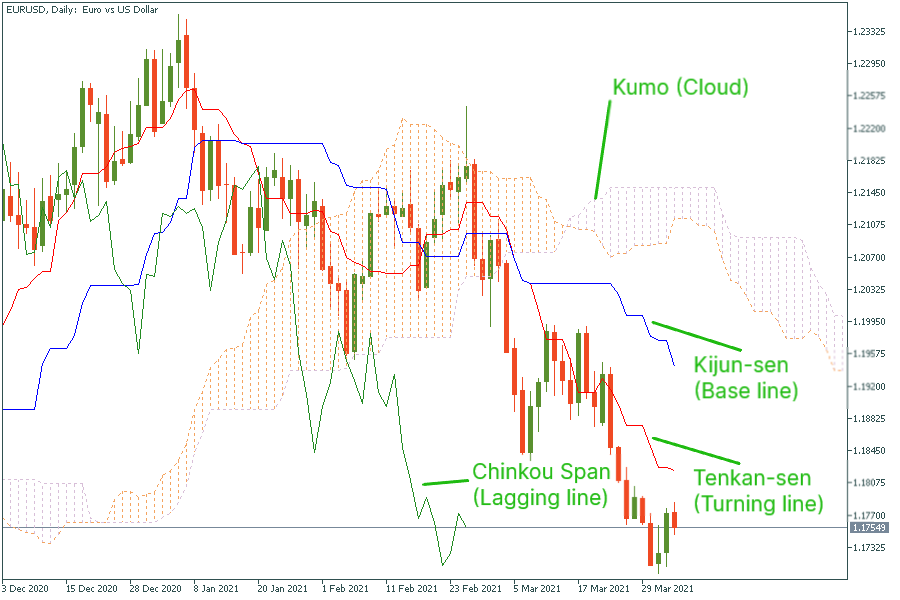

Rules for opening a long position

- Wait for the price to break above the cloud and Kijun-sen (blue line). The price should close above these Ichimoku elements. At the same time, the Stochastic oscillator should cross in the overbought zone.

- Open a buy stop position at the opening price of the next candlestick.

- Place your initial Stop Loss 30 pips below the entry bar. After 60-80 pips gain, move Stop Loss closer to the entry.

- Place your Take Profit twice bigger than the distance between the entry and the Stop Loss.

Example: On the daily chart of EUR/USD, the price was trading above the Kijun-sen and the cloud. On November 30, the stochastic oscillator crossed in the overbought zone. We opened the long trade at the opening price of the next candlestick at 1.1927. The Stop Loss was placed at 1.1897, 30 pips below the opening price. The Take Profit was located at 1.1987 (60 pips above the initial order).

Rules for opening a short position

- In this case, the price should move below the cloud and Kijun-sen (blue line). After the price closes below these lines, look at the stochastic oscillator – its lines should cross in the oversold zone.

- Open a sell stop position at the opening price of the next candlestick.

- Place your initial Stop Loss 30 pips above the entry bar. After 60-80 pips fall, move Stop Loss closer to the entry.

- Place your Take Profit twice bigger than the distance between the entry and the Stop Loss.

Example: On the same daily chart of EUR/USD, the price was moving below the blue line of Ichimoku and the cloud. On July 25, the stochastic oscillator crossed in the oversold zone. We placed a sell order at the opening price of the next candlestick. This is the 1.1145 level. We locate the Stop Loss at 1.1175 (30 pips above the entry), while Take Profit goes at 1.1085 (60 pips below the entry).

Bottom line

As we can see, with the strategy above the Ichimoku indicator looks less horrifying for a novice trader. The lines can show you the right direction of a trend and, in fact, “predict” further momentum.

LOG IN