Passive Income From Forex Trading

Trading Forex is still one of the most popular tools for passive income, and the trend is here to stay for long.

This article will tackle the concept of passive income trading, covering various options for generating passive income from Forex, tips and tricks for risk management, and more.

Read it to get a deeper understanding of Forex as a source of passive income and apply this knowledge trading with FBS.

Why Forex trading is great for generating passive income

There are several reasons why Forex trading is an excellent option for those looking to create a steady stream of income without having to participate in the process actively.

Forex trading offers the potential for high returns on investment.

The Forex market is the world's largest and most liquid financial market, with a daily trading volume of over $6 trillion. The high level of liquidity offers ample opportunities to profit from small price movements. Skilled traders can generate significant returns on their investments.

Forex trading can be done from anywhere in the world.

All you need is a computer or mobile device with an Internet connection, making it a flexible option for those who want to earn a passive income while traveling or working from home. This accessibility allows traders to take advantage of opportunities in different time zones and markets, increasing the profit potential.

Forex market is open 24 hours a day, five days a week.

This around-the-clock nature of the Forex market means that traders can set up automated trading systems or use trading algorithms to execute trades on their behalf, further enhancing the passive nature of Forex trading.

Forex trading is relatively affordable.

Leverage allows traders to control larger positions with less capital, increasing potential returns. This low barrier to entry makes Forex trading an attractive option for those looking to generate passive income without significant upfront investment.

How to generate passive income from Forex

Forex, or foreign exchange, has traditionally been associated with active, non-stop trading and complicated financial tactics. However, it's worth noting that Forex can also be used to make passive income without constant supervision or extensive trading expertise.

Today, Forex offers several passive income approaches, including:

- Copy trading & copy trading services

- Automated Trading Systems (EAs) & EA development

- Long-term investing with diversification

- Interest rate carry-trade

- Forex accounts management

- Forex affiliate marketing

- Forex trading courses and education

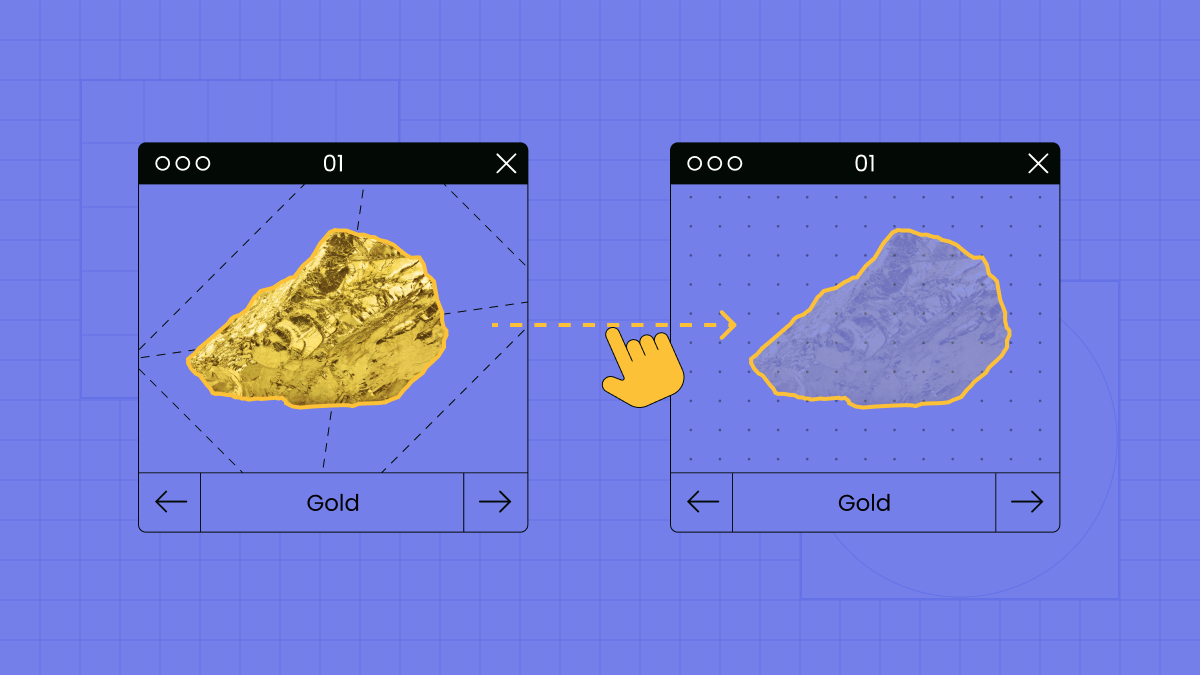

Copy trading is the perfect choice for an easy introduction to Forex trading. It's like following your favorite musician on social media: you choose an experienced trader with reliable trading strategies and a solid track record, and with just a few clicks, you subscribe to their trading signals.

From then on, whenever the expert trader makes a profit, so do you! Think of it as having a financial mentor overseeing your investments from afar. Plus, it's all automated, so you can sit back and let the experts do the work while you earn a passive income.

As you gain trading experience, you will build a reputation as an efficient trader. Your portfolio of profitable trades will attract other traders to follow your trades. That is how you can offer copy trading services.

Automated Trading Systems, or Expert Advisors (EAs), are essential for those taking up passive income trading.

You can create or buy a dependable EA that aligns perfectly with a trading approach of your choice. With EA, you get a tireless assistant constantly searching for profitable trades.

Test your EA, and if you’re happy with it, let it execute trades based on your criteria - all you have to do is watch and monitor its results.

For those with above-average programming skills, developing EAs of your own is another way to make extra money from Forex. You can create Expert Advisors for a specific strategy and market them in the Forex trading environment.

Long-term investing with diversification will suit those looking for a more passive way of trading. In short, this approach involves investing in a wide range of assets to diversify your portfolio, i.e., spread risk and reduce the need for active trading management.

Interest rate carry-trade is another simple Forex income strategy. To make it work, you simply need to buy a currency with a high-interest rate and sell a currency with a lower interest rate. Your profit will be the difference between the interest rates.

If you feel confident enough and you have a solid Forex experience to go with your confidence, you can make money by managing other traders’ Forex accounts. Your clients provide you with the capital to trade on their behalf. Your income will be the percentage of their profits, a kind of operating fee.

Forex affiliate marketing is a promotional job. You promote Forex brokers and related products and services to traders. In this case, your profit comes from subscriptions and purchases through your referrals.

Finally, you have Forex trading courses and education. If you have knowledge to share and are passionate about teaching, why not make up a course on trading? Share insights, tips, and tricks on Forex with novice traders. You can wrap it any way you like: online courses, webinars, eBooks, 1:1 consultations, etc.

The inherent risks of Forex trading

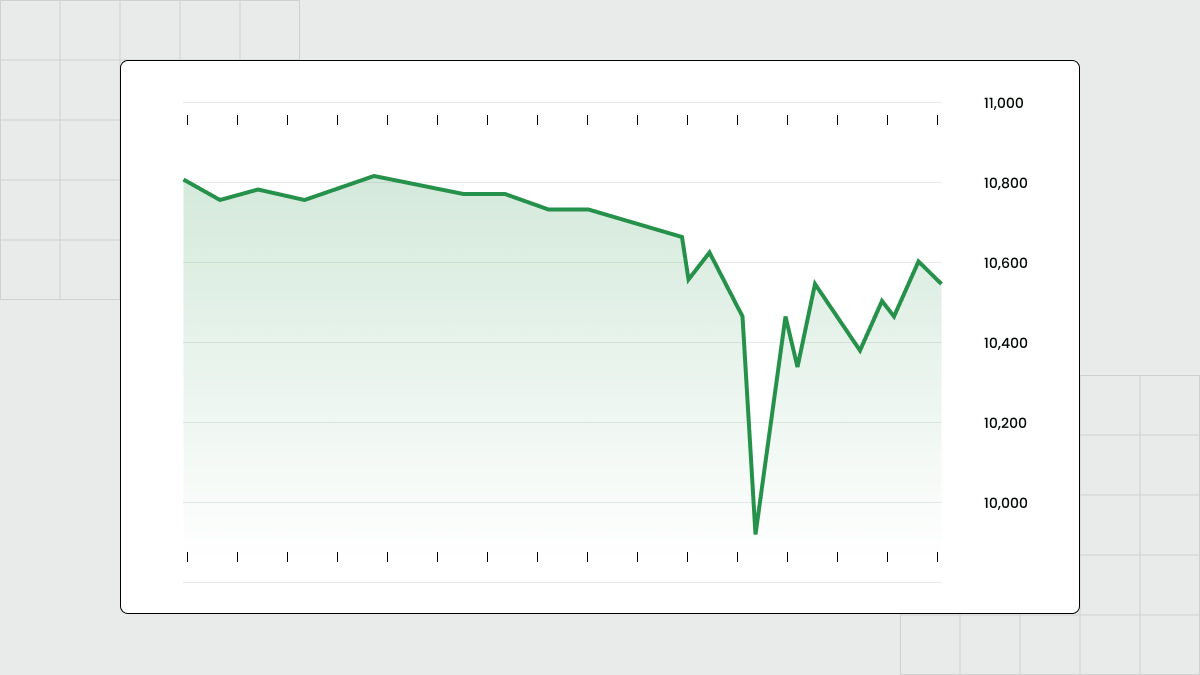

One of the primary risks of Forex trading is market volatility. The foreign exchange market is highly sensitive to geopolitical events, economic data releases, and other external factors, resulting in rapid and unpredictable price movements. This volatility can result in substantial profits but also increases the likelihood of significant losses if trades are not carefully managed.

Another risk to consider is leverage. While this tool can increase potential profits, it can also increase potential losses. Traders who use leverage borrow funds from their broker to increase the size of their positions. If the market moves against them, they may incur losses that exceed their initial investment. Therefore, understanding how to manage leverage and its associated risks is essential for Forex traders.

Movements in exchange rates can dramatically affect the profitability of trades. The Forex market is susceptible to liquidity risk, particularly during periods of low volume or market disruption, which can lead to wider spreads and slippage.

Finally, foreign exchange trading is subject to operational and counterparty risk. Operational risk includes technical problems, platform failures, and connectivity issues that may affect the execution of trades. Counterparty risk arises from the possibility that a broker or financial institution may fail to meet its obligations, potentially resulting in financial losses to traders.

Avoiding Forex risks

Mitigating the risks of Forex trading requires a combination of risk management strategies, thorough research, and disciplined trading practices. Here are some critical steps to reduce the risks of forex trading while generating a passive income:

Education and research

Before engaging in forex trading, investing time in learning about the forex market, trading strategies, and risk management techniques is essential. Understanding the market dynamics, economic indicators, and geopolitical events can help you make informed trading decisions.

FBS offers tons of helpful information on the market, including free education, news, and the tools such as Economic Calendar that make for smoother and more effortless trading.

Risk management

Implementing effective risk management practices is critical. This includes setting stop-loss orders to limit potential losses on trades, using proper position sizing to control the amount of capital at risk, and avoiding over-leveraging positions. In addition, diversifying your trading portfolio across different currency pairs can help to spread risk.

Use of leverage

While leverage can increase potential profits, it also increases the risk of substantial losses. Consider using conservative leverage levels and avoid exposing your trading account to excessive leverage.

Long-term perspective

Instead of focusing on short-term profits, consider taking a long-term view when trading forex for passive income. This approach can reduce the impact of short-term market volatility and allow for more strategic decision-making.

Automated trading systems

Automated trading systems or algorithms can reduce emotional decision-making and provide a disciplined approach to trading. These systems can be programmed with specific risk parameters and trade management rules.

Diversification

Diversifying your investments across asset classes and income streams can help reduce overall portfolio risk. Consider including other passive income streams such as dividend stocks, real estate investments, or other financial instruments in addition to forex trading.

Regular Monitoring

Monitor your trading positions and adjust your strategy based on changing market conditions. Stay informed about economic news, central bank policies, and global events that may affect the currency markets.

Professional Advice

Consider seeking the advice of experienced Forex traders or financial advisors who can provide insight into risk management strategies and help you develop a well-rounded approach to Forex trading income.

Conclusion

Passive income from Forex is a wide field of money-making opportunities that involve various related approaches. It is still one of the most popular ways to make extra money, and the number of Forex enthusiasts is growing.

However, one must be aware of the financial risks involved in Forex trading and learn tools and techniques to avoid mistakes.

FAQ

Can Forex trading be passive income?

The short answer is yes, you can make extra cash by trading Forex. However, Forex passive income doesn’t mean only trading – you can go as far as developing EAs, promoting brokers, related products and services, and teaching Forex to other traders.

What is the fastest way to make money in Forex?

Efficient Forex trading income requires understanding the potential for compound growth. For example, targeting a 50% annual return on your trading could take a starting account of $20,000 to over $1 million in less than a decade.

What's the best passive income for beginners?

Forex passive income is one of the best passive income opportunities for beginners. It's affordable, requires minimal equipment, and doesn't take too much time. However, the key to entering Forex is knowledge. Proper self-education, broker-provided courses, or lessons from renowned traders will make your first steps in Forex trading much easier and reduce the number of rookie mistakes as you explore the market.

What is the easiest form of passive income?

Forex income can be one of the easiest ways to make extra money. Accessible and affordable, Forex trading is gaining popularity worldwide as a modern-day source of income. You can choose from several strategies that suit your lifestyle, the amount of time you can devote to trading, and your budget. Also, Forex offers enough room for professional growth - you can become a trading expert and teach others, develop expert advisors, promote brokers, their products or services, and more.