The 20 Most Important Trading Rules

In the dynamic world of trading, making sustainable profits takes a lot of work. However, there are 20 trading rules that serve as pillars, supporting seasoned traders and novices as they navigate the complexities of stock market dynamics. Master trading rules now by reading this article in just 5 minutes.

1. Let the money flow

Trading Forex with flowing profits requires informed decisions based on objective indicators rather than gut feelings. So, the first rule of trading stocks or other instruments is to close deals strategically while mitigating risks. You can identify a trend’s end, close a trade, or follow your preset Take Profit to secure profits without rush acts.

2. Control your risks

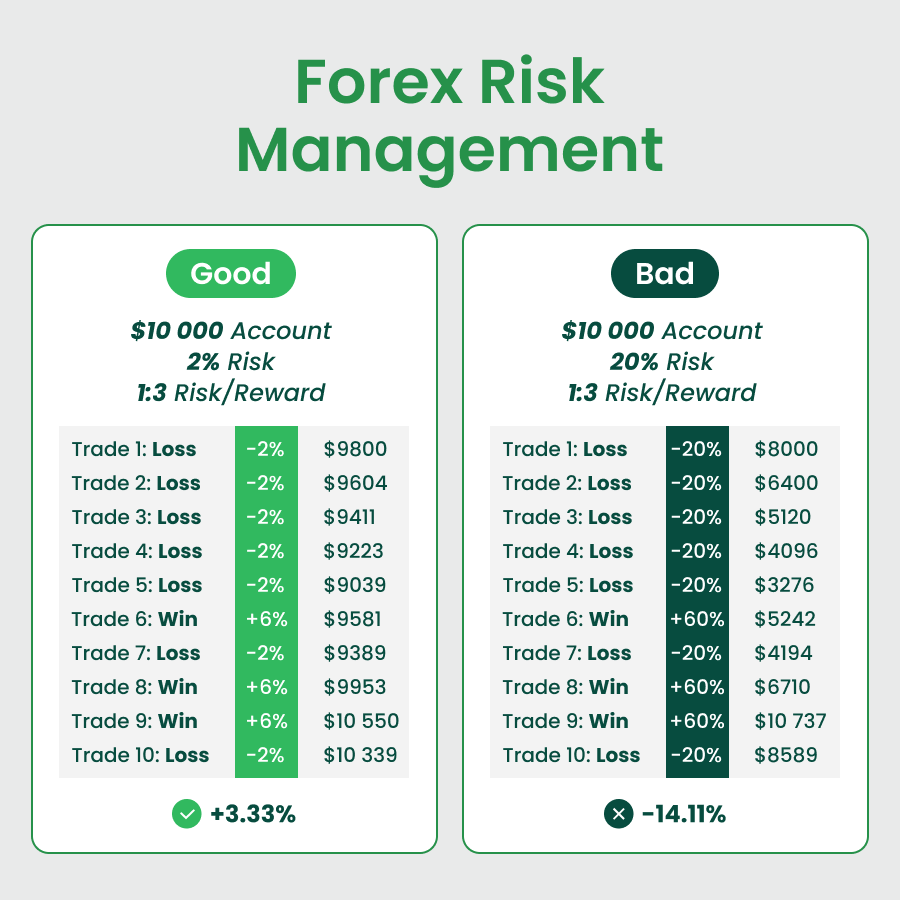

Risk management is a cornerstone of every trader’s foundation that helps to define how much capital to risk per trade, understand potential losses, and implement strategies to preserve and grow the trading account. The classic trading rule in the stock market is to risk from 1% to 3% per trade.

Imagine you have a $10.000 account, 2% risk, and a risk-to-reward ratio of 1:3. Thus, even if 7 of 10 trades will be closed with losses, you still can make profits, closing only three trades with 6% of profits (see the image below.) But if you set a 20% risk with the same account and conditions, you can lose 14.11% of your account.

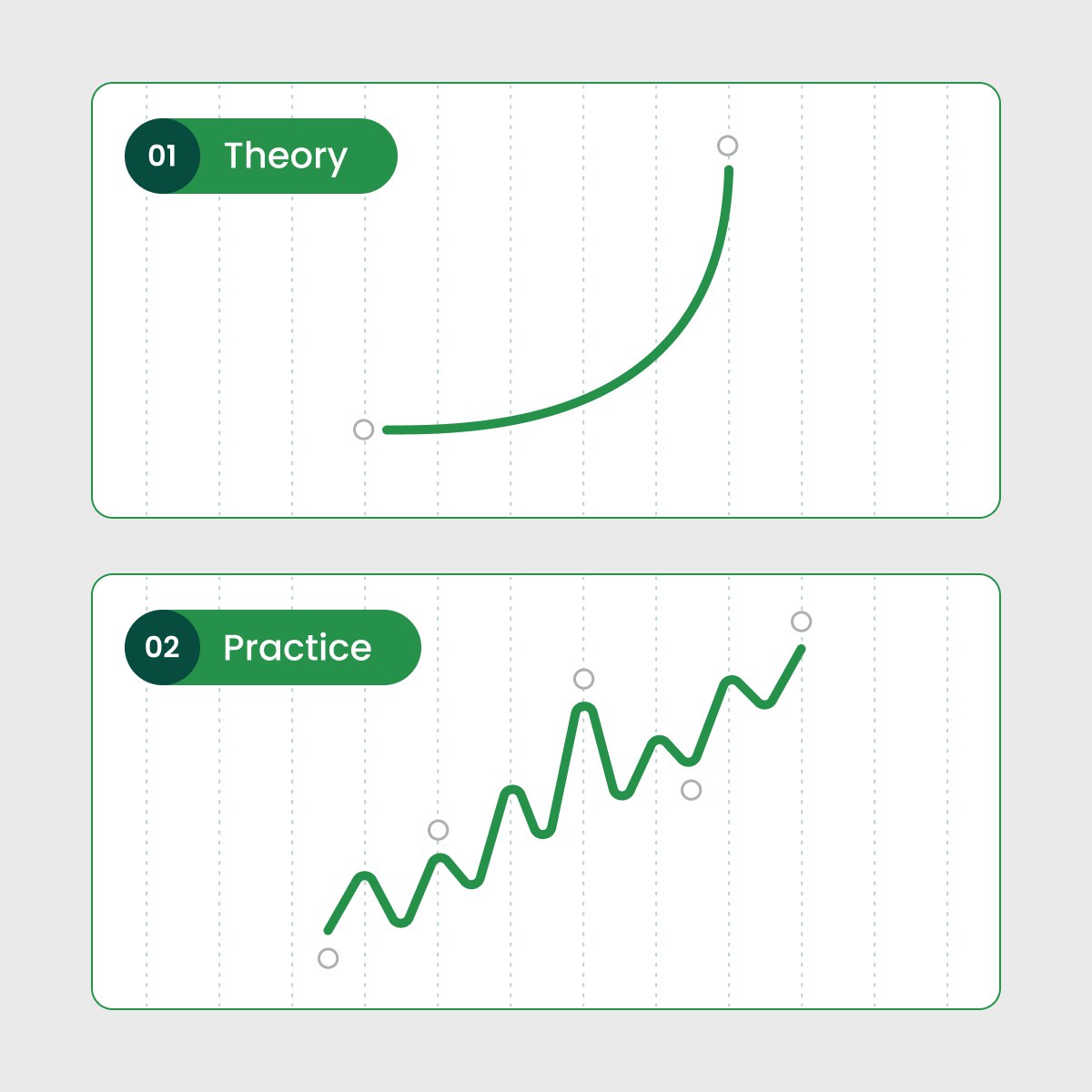

3. Practice makes perfect

Mastery in trading requires practice. A crucial part of rules for trading is to hone traders' skills on a real account, learn from both successes and failures and refine strategies to adapt to changing market conditions. World-famous traders like George Soros and Steven A. Cohen didn’t reach heights in one day; they practiced skills for years before making sustained gains. So, realize that theory is vital, but practice makes your trading perfect, and your expectations do not always meet reality.

4. Keep your strategy simple

Simplicity isn't a compromise; it's a strategy that requires a focus on vital indicators, elimination of unnecessary information, and clear, concise decisions. A simple strategy streamlines actions and minimizes confusion.

Like Occam’s razor principle, which advises choosing the simplest explanation, focusing solely on vital indicators while cutting unnecessary information. Simply put, this principle favors the simple over the complex. Overcomplicated strategies often lead to indecision and inefficiency. Embracing simplicity allows traders to react swiftly to market movements and make more confident decisions. Applying Occam’s razor to your approach means concentrating on essential information and ensuring clarity and efficiency in your trading strategies.

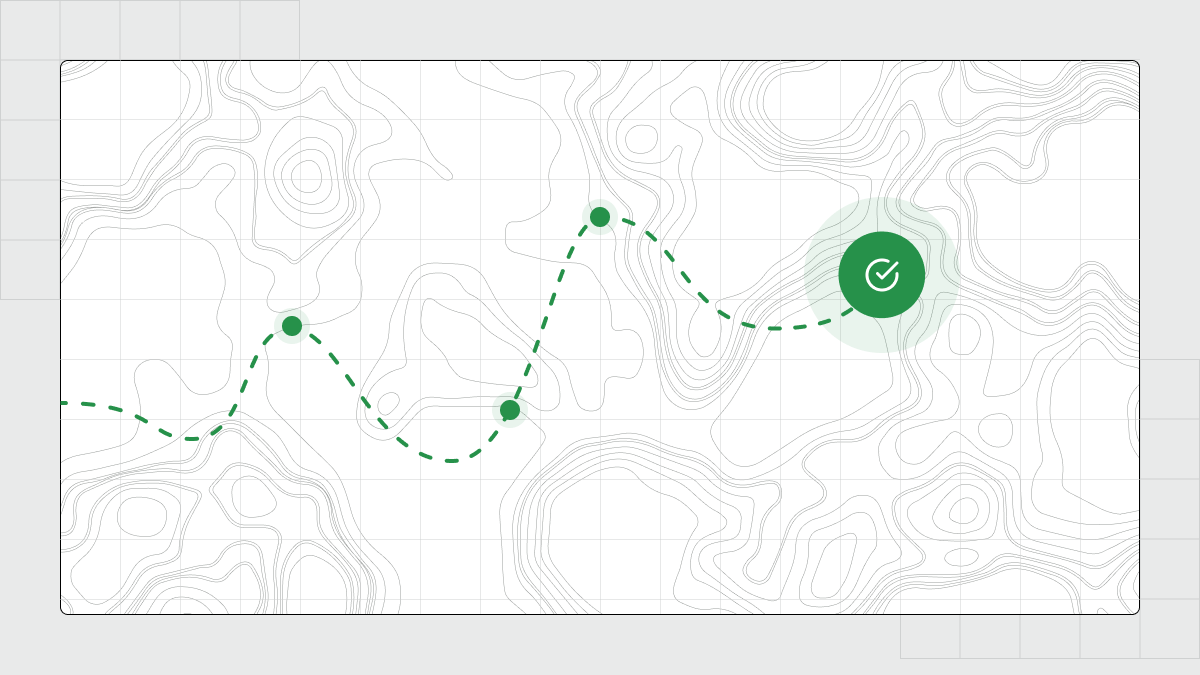

5. Plan your trade and trade your plan

Trading without a plan is like sailing without a compass. Another critical component of forex trading rules is to create a blueprint for each trade, including entry and exit points, and stick to it. A well-thought-out plan ensures you're not merely trading impulsively, where the outcomes often remain beyond your control. Without controlling the result, even profits may lack systematicity, making it uncertain whether they can be replicated in the future.

However, when you have a defined plan and control the results, even if the profits aren't substantial, they're earned through honest, systematic work. This controlled approach increases the likelihood of repeating successful outcomes. By sticking to a predetermined strategy, traders establish a disciplined framework. This discipline fosters an environment where consistent and repeatable profits become more probable, ensuring that even moderate profits are earned through a systematic and structured approach.

6. Train your discipline

Market fluctuations are inevitable, but discipline is a choice and a vital aspect of trading rules. Wealthy traders can stay calm amid chaos, control emotions, and follow a well-thought-out plan. Trading without a structured plan often leads to spontaneous decisions, resulting in a lack of control over outcomes. When you lose control over the result, even profits become unpredictable and lack systematicity, making it uncertain whether they can be replicated in the future.

7. Lose the crowd

Another crucial approach in the rules of trading stocks and other instruments is to have your own view and deep understanding of market movements because the herd mentality rarely leads to sustainable success. It's about charting your trading style and strategy based on meticulous analysis rather than blindly following popular trends.

8. Engage your trading plan

A trading plan is a keystone. However, creating a plan is just the beginning; executing it thoroughly is the real challenge. Staying true to the plan, you can avoid impulsive decisions that may lead to undesirable consequences.

9. Avoid market gurus

While guidance is valuable, blind allegiance to self-proclaimed experts can be detrimental. Moreover, millions of fake "trading gurus" can simply get your money without knowing any Forex trading rules. It's better to learn from only reliable trading educators and use their insights as a reference while relying on your analysis and critical thinking. Our guides prepared by FBS financial analysts can help you increase your trading skills.

10. Use your intuition

Balancing data-driven decisions with intuition is an art and one of the most challenging rules of Forex trading. But by increasing your experience, you'll be able to allow your intuition to complement analysis without overshadowing the importance of strategy. And if you have a strong feeling to adjust your strategy and enough experience to do that, follow your intuition.

11. Don't fall in love

Trading requires rationality. Avoid emotional attachment to trades or assets, following the trading rules of objective analysis. Emotional biases can blind traders to potential risks, making it crucial to base decisions on objective analysis rather than emotional attachment.

12. Organize your personal life

Your personal well-being influences your trading results as well. To improve your decision-making and overall trading performance, you should maintain balance, manage stress, and ensure a healthy lifestyle. So, before opening a trade, make sure you don’t have distracting thoughts in your mind.

13. Don't try to get even

Trading without losses is impossible, and wise traders learn from losses and don't try to get immediate recovery, which can lead to impulsive decisions. It's important to avoid overtrading or unnecessary risks to offset losses.

14. Watch for warnings

Various warning signs exist in markets, from technical indicators to global economic trends. Recognizing and heeding warnings is crucial. Don’t ignore or neglect these signs, which can result in significant profit or loss, challenging the essence of stock market trading rules.

15. Forget the holy grail

There's no magical formula for guaranteed trading success. Avoid chasing after the "holy grail" strategy. Success is built on a well-thought-out, adaptable, and disciplined approach rather than seeking an elusive secret formula.

16. Ditch the paycheck mentality

Trading isn't a fixed-income, nine-to-five job. Avoid approaching it with a paycheck mindset. Profits fluctuate, and understanding this volatility is essential to grow your trading account.

17. Don't count your chickens

Anticipating profits prematurely can lead to hasty decisions. Wait until a trade reaches its logical conclusion based on your strategy rather than prematurely celebrating potential gains. This aligns with the importance of maintaining discipline in trading rules.

18. Embrace simplicity

Complexity doesn't ensure success. Simplify your trading strategy, focus on vital indicators, and avoid unnecessary complexities for better trading performance.

19. Make peace with losses

Accepting losses as part of trading helps maintain emotional stability and aligns with the golden rules of forex trading. Learn from your losses to grow and improve future strategies rather than lament them.

20. Beware of reinforcement

Reinforcement can lead to repetitive, often impulsive behaviors based on past successes. Stay vigilant against overconfidence and stick to a well-defined plan.

The journey to becoming a successful trader involves continuous learning and adaptation. Master these 20 trading rules and integrate them into a comprehensive trading plan and mindset.

The art of trading is both a science and an art. It involves analyzing data, understanding market psychology, managing risks, and making timely decisions. It demands discipline, patience, and a commitment to ongoing education.

Conclusion

In conclusion, the 20 crucial trading rules aren't just a set of guidelines; they're a compass guiding traders through the ever-changing tides of the financial markets. Mastery in trading isn't achieved overnight; it's a journey paved with dedication, continuous learning, and a willingness to adapt.

Successful traders aren't merely participants in the market; they're strategists, risk managers, psychologists, and lifelong learners. Embracing these rules and evolving with the market dynamics is the path to sustained success in the captivating world of trading.

Frequently Asked Questions (FAQ)

What is the most important rule in trading?

Disciplined risk management is pivotal. By controlling risks and preserving capital, traders safeguard against substantial losses, ensuring sustainability in the market.

What is the 90% rule in trading?

The 90% rule is a commonly cited statistic, stating that 90% of novice Forex traders lose 90% of their money in the first 90 days. This rule reminds traders of the harsh reality of trading and the importance of risk management and effective strategy.

What are the golden rules of trading?

Disciplined risk management, adherence to a trading plan, avoidance of emotional decisions, continuous learning, and adaptability to market conditions encompass the golden rules of trading. These principles act as guiding beacons for navigating volatile markets.

What is the number one rule in day trading?

Effective risk management takes precedence in day trading. Implementing stop-loss orders to limit potential losses and maintaining discipline with predefined entry and exit points are fundamental strategies for successful day trading.